The cryptocurrency community is currently embroiled in a heated debate over Justin Sun’s involvement in the custody operations of Wrapped Bitcoin (WBTC). BitGo’s recent decision to transfer WBTC control to a joint venture with Sun’s BiT Global has triggered widespread concerns, particularly among DeFi players.

BitGo, a leading crypto custody platform, recently announced plans to transition the custody of WBTC to a new joint venture with BiT Global, a company connected to Justin Sun, the controversial founder of TRON. This transition, which will take place over the next 60 days, has sparked significant backlash from various segments of the cryptocurrency community.

Sun’s track record in the crypto world has been checkered with multiple controversies. His management of the TRON network has faced criticism for centralization. His lack of transparency is highly disliked by the crypto community. He has been involved in various legal issues, including allegations of fraud, misleading investors, and regulatory scrutiny in both China and the United States.

Moreover, his previous Bitcoin wrapper, $HBTC, didn’t fare so well. As of today, $HBTC is trading at a price of $13,300 per coingeccko, far lower than its counterpart, Bitcoin. Justin Sun’s

BitGo CEO Mike Belshe has downplayed these fears, suggesting that the controversy is driven by perceptions rather than facts. Though he was unable to share BiT Global’s ultimate beneficial ownership, directors, and officers. He also noted that “if BiT Global is fully compromised…the treasury could be at risk.”

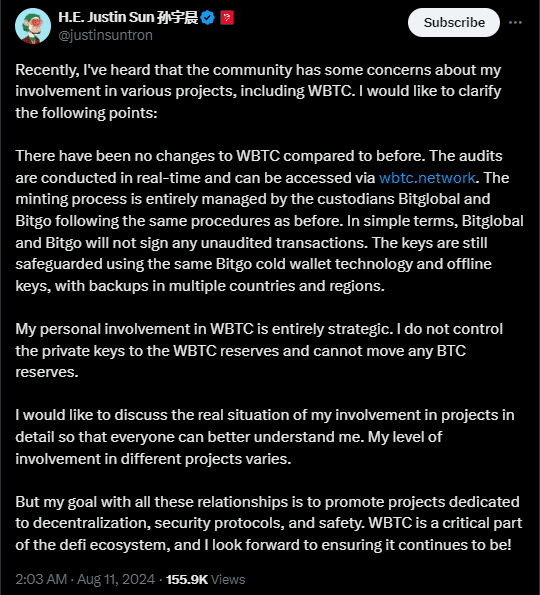

Sun has sought to reassure stakeholders, stating that his role in WBTC is purely strategic and that he does not have control over the private keys or the ability to move Bitcoin reserves.

Despite these assurances, key DeFi players, notably MakerDAO, have expressed serious reservations. MakerDAO’s risk unit, BA Labs, proposed offboarding WBTC from its lending platforms due to the potential risks associated with Sun’s involvement, citing parallels with past controversies involving Sun, such as transparency issues with TUSD.

Crypto community members further suggest that custody should be handled by financially robust institutions like traditional finance companies or Coinbase. They believe that even if BitGo has a long-standing reputation, this partnership might tarnish its reputation if problems arise.

Apart from all this, the crypto community fears that WBTC carries the risk of depegging. Everyone fears that if WBTC’s peg were to break significantly, it could lead to cascading liquidations, given its widespread use as collateral in DeFi.