Reserve Bank of India (RBI)- the apex bank of India announced an upcoming nationwide launch of Unified Lending Interface (ULI)- a centralized public tech platform- through which banks and financial institutions can offer loans to Indian customers after a quick credit check.

The ULI which is modelled after the extremely popular Unified Payments Interface (UPI) system, has been introduced by the Indian government vis-a-vis the RBI to check on the menace of Chinese quick loan apps that target Indian users with predatory loans and later convert the proceeds into cryptocurrencies to evade detection.

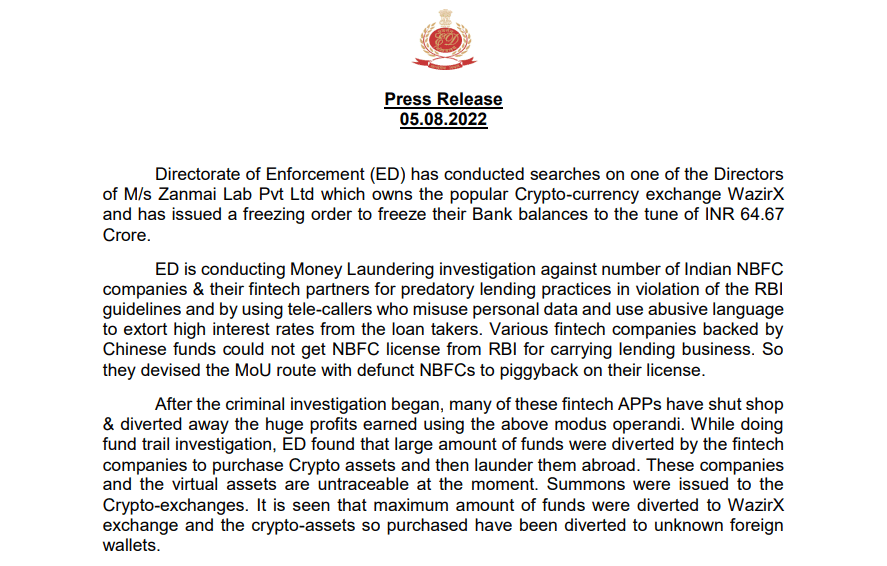

The action comes after India’s financial crimes investigative agency ‘Enforcement Directorate’ had observed several Chinese funds backed fin-tech companies have been involved in predatory loan practises via mobile applications and the proceeds of these crimes were later converted into cryptocurrencies. ED had also observed that a majority of these proceeds were deposited into WazirX cryptocurrency exchange, which is currently facing a hacking led funds deficit crisis.

To check on rising incidents of Chinese loan apps targeting Indian users, the RBI had launched a pilot project in August 2023 to check whether a unified platform could deliver frictionless credit to investors with quick back check and credit score check processes.

Through ULI, India intends to bring together all licensed financial institutions of the country and customers on a single public platform to bring greater efficiency, security and transparency in the money lending process and also to thwart the growth of predatory Chinese loan apps.

The menace of Chinese Loan Apps in India

Ever since the advent of Covid-19 induced pandemic, Indian markets were flooded with China based quick loan applications that targeted citizens from lower income groups, luring them with prospects of easy loan dispersal. However, according to Indian investigative agencies, the apps were unlicensed entities and had predatory policies like 15-20 days lending period with sky high interest rates.

Victim borrowers of the app were then harassed by loan agents of the Chinese apps to pay their remaining dues often leading to complaints of blackmailing and threatening. The issue came under the radar of Indian agencies after several loan app victims committed suicide due to threats from the unscrupulous loan agents of the apps.

According to ED, the Chinese entities were initially denied Non Banking Financial Company (NBFC) license by RBI to hold operations in India, therefore the Chinese apps looked for a loophole and started doing Memorandums of Understanding (MoU) with defunct NBFCs of India.

A probe by ED disclosed that the loan app agents often posed as tele-callers and offered lucrative loans to lower middle class Indians. The agents then used abusive, intimidating language and threats of blackmail to force the victims to pay the extremely high interest rates.

ED had noted that the proceeds of these financial crimes including fraud were being converted into cryptocurrencies and the maximum amount was deposited into WazirX exchange. Noticeably, WazirX exchange co-founder Nischal Shetty had recently revealed that atleast 34% INR funds of Zanmai Labs Private Limited- the parent company of WazirX- were freezed by agencies due to investigations for money laundering.

How can ULI stop the menace of Chinese Loan Apps?

According to RBI, ULI will be developed on the basis of UPI, which is India’s instant digital payment system, designed to seamlessly facilitate payments of inter-bank peer-to -peer (P2P) and person-to -merchant (P2M) through a common platform. Currently, the data including credit score of millions of customers in India is distributed among various public and private entities in different states of India. Through ULI, all data will be centralized so that financial institutions can check credit scores of customers instantly and disperse loans.

The RBI says that UlI will serve as a verified and safe platform for all citizens to avail home, student, vehicle and personal loans including small amount quick loans from all available banks and NBFCs. The backing of RBI behind NBFCs and Banks will ensure that citizens are not cheated with predatory loan practices applied by Chinese loan apps.

Conclusion

The introduction of ULI in the world’s most populous nation would be a game changer given how the Indian government has been promoting digitalization of services including banking. The rising threat of predatory loan apps and their misuse of crypto exchanges is also a sharp reminder of the perils of the crypto industry.