Bitcoin price has dropped below $59,000, raising concerns among investors and prompting questions about the reasons behind this decline. Several key factors, including macroeconomic developments and market trends, are driving this selloff.

A major factor contributing to Bitcoin’s price drop is a substantial selloff by a whale. According to Whale Alert, a large holder transferred 2,300 BTC, worth approximately $141.81 million, to Kraken before the recent downturn.

This massive movement of assets raised alarms in the crypto community. Despite this, the whale still holds 18,141 BTC, valued at $1.07 billion. If this whale decides to sell more, it could put additional downward pressure on Bitcoin’s price.

Investor caution is also evident as they await significant earnings reports from major tech companies. Nvidia, Salesforce, CrowdStrike, and HP Inc. are set to release their Q2 results soon, with Nvidia’s report due on August 28.

These earnings are expected to influence market sentiment and potentially affect riskier assets like Bitcoin. Wolfe Research highlights that Nvidia’s performance could play a crucial role in shaping market expectations.

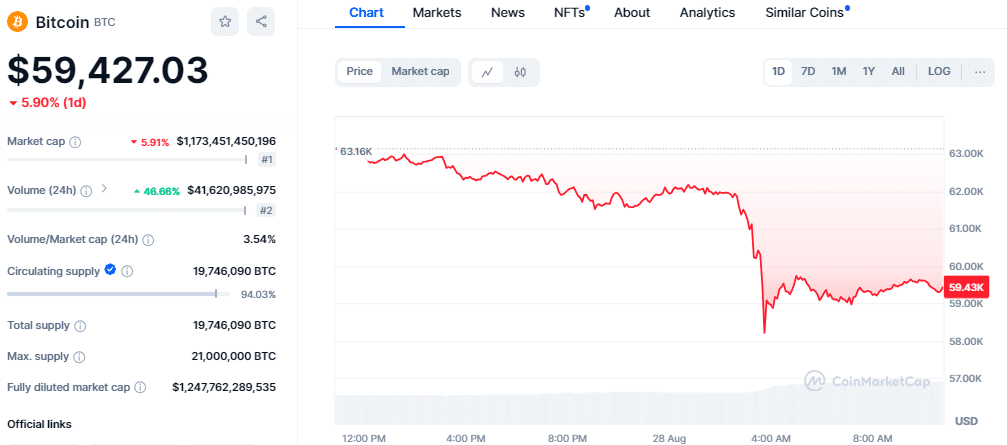

Currently, Bitcoin is trading at $59,427, down 6.59% with a 46% increase in trading volume to $41.62 billion. The cryptocurrency hit a low of $58,211 and a high of $63,210.80 in the last 24 hours.

Additionally, Bitcoin Futures Open Interest has decreased by 7% to $31.09 billion, and $26.35 million in Bitcoin has been liquidated in the past hour. Despite the downturn, some predictions suggest Bitcoin could rebound to $65,000 if it breaks a key resistance level.

Also Read: Bitwise Bitcoin ETF Acquires Osprey Bitcoin Trust