The WazirX exchange has set aside $12 Million USD (INR 100 Crores) for legal costs and expenses incurred during investigation of the cyber hack that had resulted in loss of 45% user funds from the exchange last month.

Additionally, WazirX has received four legal notices from different parties for recovery of their funds from the exchange since the July 18 hack on its multi-sig wallet that resulted in theft of crypto assets worth Rs 2000 crore ($230 Million). On Wednesday, CoinSwitch, an Indian crypto exchange, announced that they will sue WazirX for recovery of their funds worth Rs 80 crore invested in the exchange.

Additionally, WazirX has a total of 1.6 crore active users uptil the hack of July 18 and out of them 44 lakh had crypto holdings. After facing immense pressure from users, WazirX had allowed only 66% INR withdrawal per user in two separate phases and a six months window for 100% crypto withdrawals per user.

These details are part of the 52 pages long affidavit filed by WazirX’s parent company Zettai Pte Limited in the Singapore High Court for a moratorium under the Singapore’s Insolvency, Restructuring and Dissolution Act 2018. WazirX shared the affidavit with their customers on Wednesday via email and The Crypto Times team also had a sneak peek into it.

What is in the WazirX Affidavit?

We present to you highlights of the 52 page affidavit submitted by WazirX through Zettai in Singapore High Court.

Hostile and Frustrated Users

According to the affidavit filed by Zettai, the “frustrated and hostile users” of WazirX might seek legal recourse against the exchange to seek recovery of their funds and hence the moratorium application will buy them time.

“Further, as of 24 August 2024, the Platform has already received upwards of 9,700 withdrawal-related emails and platform messages. It is foreseeable that frustrated and hostile users of the Platform may commence legal proceedings against all entities involved in the Platform’s operations (past and present). To this end, between 21 July 2024 and 2 August 2024, the Platform has received 4 legal notices. Resolving such legal proceedings would consume considerable time and resources, which would frustrate genuine attempts at restructuring and would not be beneficial for the general run of the Platform users,” read the affidavit of WazirX.

Socialistic Loss-Sharing Policy

According to the affidavit, the recovery plan includes a 30-day automatic moratorium to protect Zettai from legal actions and halt any winding-up resolutions. The restructuring will distribute the impact of the hack pro-rata among unsecured creditors, with users receiving a share of available token assets based on their claims. Some details of the recovery process remain confidential.

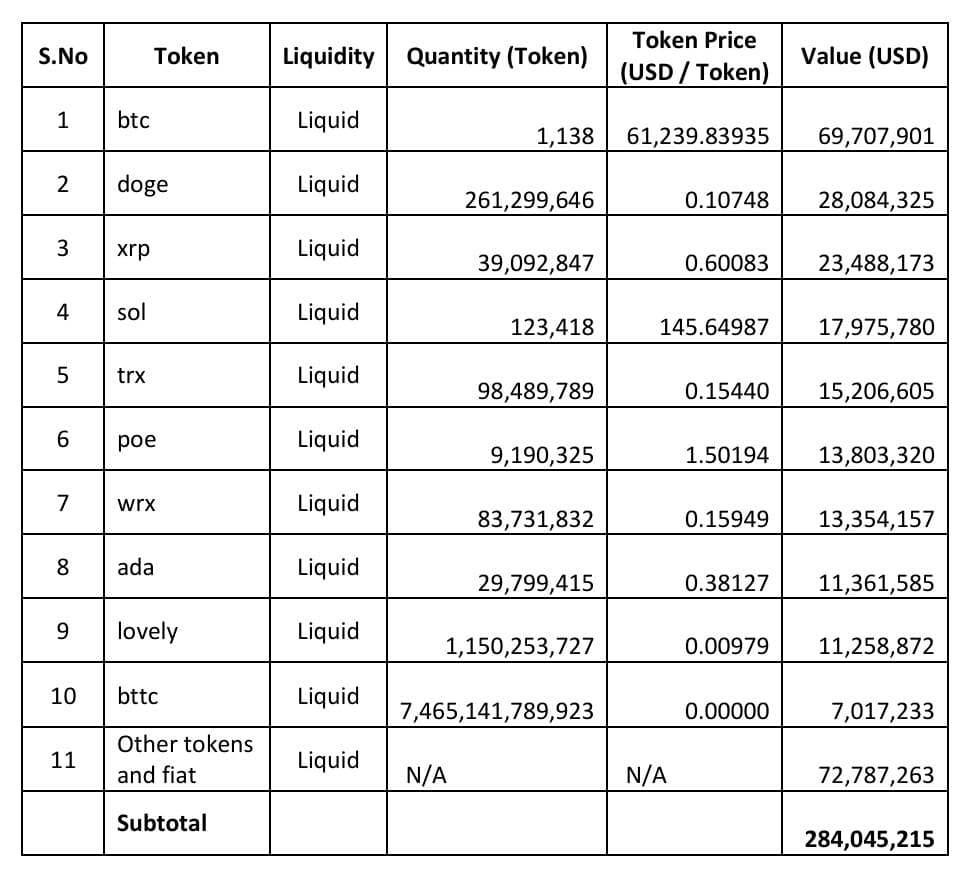

The recovery plan involves distributing the $284 million in remaining assets on a pro-rata basis among affected users based on their account balances. The company aims to distribute these assets fairly among users classified as unsecured creditors. The company is also engaging with 11 potential investors, known as “white knights,” including major cryptocurrency exchanges, to secure capital injections and strategic partnerships for asset recovery and operational costs.

100 Crores for Legal Fees, Investigation Costs etc

WazirX has earmarked $12 million for legal fees, investigation costs, and other essential expenses related to the restructuring process. The company is exploring liquidity management options to provide immediate relief to users while developing long-term recovery strategies. Before the hack, the total value of assets was $570 million, with $284 million remaining.

Upcoming Town Hall Session on September 2

The affidavit claims that avoiding bankruptcy is crucial, as it could prevent potential help and investments from white knights. On September 2, the WazirX team and its advisors will participate in a town hall session to explain the latest developments. This approach is designed to stabilize the platform and address immediate user needs, and facilitate long-term recovery.

Dispute between WazirX and Binance

The dispute between Binance and WazirX centers on the control and ownership of the WazirX platform. Binance initially engaged in a transfer deal with WazirX but later sought to back out, leading to a public conflict over control of the platform’s digital assets.The affidavit also mentions the financial gains of Binance and WazirX, highlighting that both companies reported substantial profits from FY 2019-20 to FY 2021-22.

Binance’s move to close the wallets holding these assets, contrary to earlier promises from CEO Changpeng Zhao, forced Zettai, associated with WazirX, to take over the tokens to maintain the platform’s operations. Zettai then enlisted Answer Eleven Pte Ltd (Liminal) to manage the assets securely. The dispute remains unresolved, with further details kept confidential.

Conclusion

Despite the affidavit’s details on investigations, recovery and WazirX’s acquisition by Binance, users are left questioning why their funds weren’t better safeguarded. Online criticism includes accusations of dishonesty and demands for the return of the ₹2000 crore in stolen crypto.

Frustration is escalating as users question WazirX’s transparency and effectiveness in its recovery efforts, with growing doubts about the full return of their funds. With reduced trading volumes and limited interest from potential investors, WazirX is struggling, leaving users to face ongoing uncertainty and a lack of resolution.

Also Read: Staring at Imminent Collapse, WazirX Owner Floats Conspiracy Theories