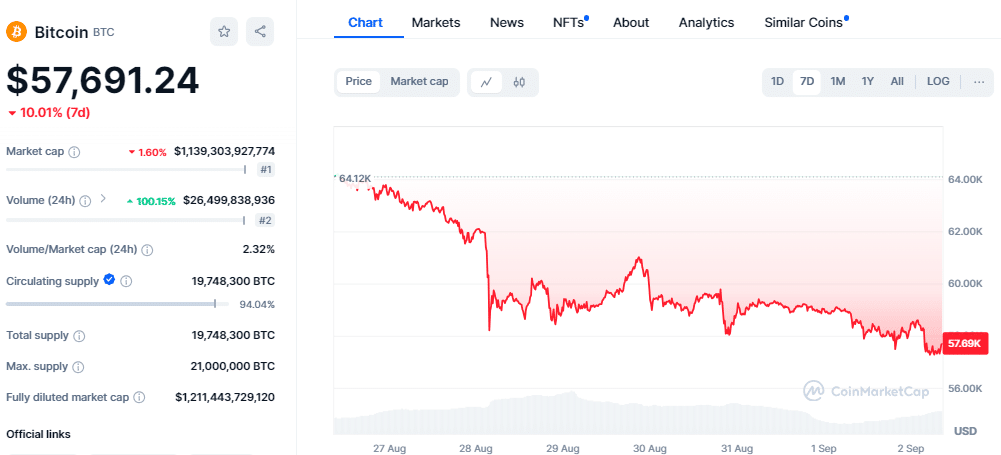

Bitcoin (BTC) is off to a rough start in September after losing 10 % in August. The cryptocurrency is battling strong selling pressure, and it’s now hovering near a fresh two-week low at around $57,270, a level last seen in mid-August.

The ongoing weakness has weighed heavily on the broader crypto market, with several altcoins losing their recent gains as well. The overall sentiment remains bearish, with traders keeping a close eye on the $55,724 support level. A break below this could push Bitcoin price toward the critical $49,000 mark.

On the flip side, some market watchers believe a potential rate cut by the U.S. Federal Reserve on September 18 could be a game-changer. The FedWatch Tool shows a 30% chance of a 50 basis point rate cut, which might trigger a rally in risk assets, including Bitcoin.

For now, the bulls are running out of time. They need to push Bitcoin back above its moving averages to spark any meaningful recovery. If successful, BTC price could climb toward $65,000 and potentially hit $70,000.

However, the immediate focus remains on the key support zones. A failure to hold these levels could result in further declines, with the next major support at $54,000.

September is historically a tough month for Bitcoin, with average losses of 4.5%. Traders are bracing for more volatility, with some expecting a potential short squeeze that could target $61,300.

As the market navigates these uncertain waters, all eyes are on Bitcoin’s price action in the coming days. Can the bulls defend the crucial support, or will September continue to be a challenging month for BTC?

Also Read: Bitcoin Sees Surge in Demand as Fed Hints at Interest Rate Cut