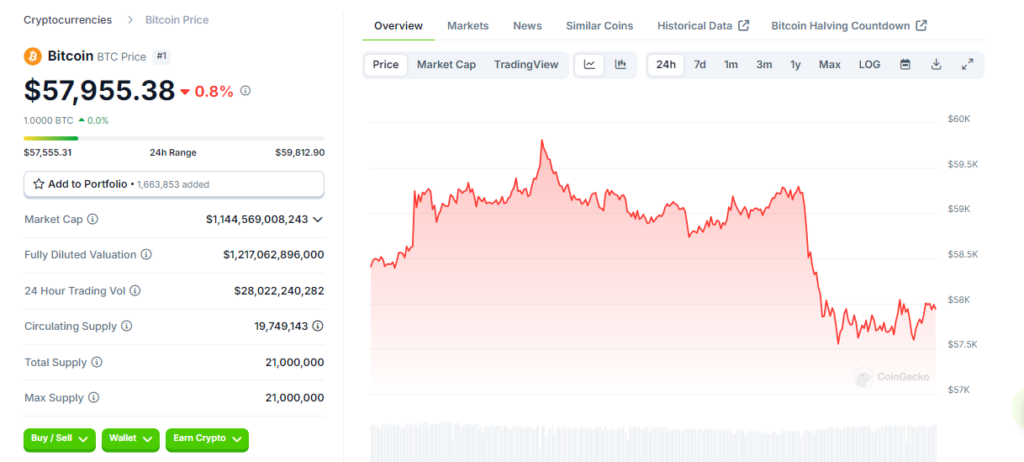

Bitcoin experienced a significant drop in its value and was trading below $58,000 during early trading today contributing to the decline in the cryptocurrency and financial markets.

The decline was even more significant for Bitcoin which fell 1.5% to $57,800 and Ethereum which dropped to a low of $2,442, 3% lower than its February low. These cuts are a clear indication that investor confidence is declining broadly across different sectors of the market.

Traditional markets were not shielded from some drawbacks, whereas the Nasdaq dropped its value by 2.4%, and the S&P 500 was also down by 1.5%. This general market decline has occurred alongside economic signals that have increased extended concerns with economic stability.

Additionally, the recent ISM Manufacturing PMI numbers indicate that the manufacturing sector is still in a decline with its current value at 47.2 which is just below the estimated value of 47.5.

This contraction points towards a worrisome development of stagflation where there is simultaneous slowing down of the economy and a rise in inflation evidenced by the decrease in new orders and increase in the prices paid.

These mixed economic signals have influenced market speculation regarding the Federal Reserve’s next moves.

Traders have increased their bets on a substantial rate cut, with the probability of a 50 basis point reduction in September rising to 39% from 30% a day earlier. Despite this, the majority still leans towards a 25 basis point cut.

All eyes are now on the forthcoming U.S. employment report for August, expected this Friday. Economists are hopeful for an uptick in job creation to 160,000 from the softer July figure of 114,000, alongside a potential dip in the unemployment rate to 4.2% from 4.3%.

Despite the downturn, historical patterns provide a silver lining. According to Alex Thorn of Galaxy Research, although Bitcoin typically underperforms in September, it often recovers in October and continues to perform well throughout the fall.

As the market braces for more definitive economic indicators, the immediate future for cryptocurrencies like Bitcoin remains tied to broader economic trends and central bank policies. Investors and analysts alike await the upcoming employment data, which could significantly influence market trajectories in the closing months of the year.

Also Read: Bitcoin Price May Fall 15-20% Following Rate Cuts this Month