In the first debate on September 10 in Philadelphia, Vice President Kamala Harris and former President Donald Trump didn’t talk about cryptocurrency at all. This led to Trump’s chances of winning the 2024 election falling to a tie on the betting platform Polymarket.

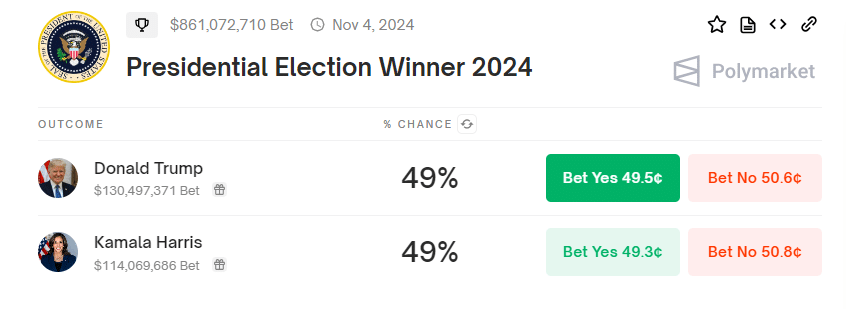

The issues that were discussed in the two hours included economic plans, abortion, immigration, and foreign policies. The odds of Trump’s victory decreased by up to 3% on Polymarket, positioning him at 49% with Harris. This change can be attributed to increasing levels of ambiguity regarding the outcome of the election among the bettors.

Harris, who was composed and tenacious during the debate, interrupted Trump, who looked irate and made several false statements, as PolitiFact noted.

The outcome of the debate has been felt in the crypto market. Some experts have estimated that if Trump wins, the Bitcoin rate could rise to $ 90,000 per coin by the end of the year. Trump has vowed to repeal anti-crypto regulations and turn the U.S. into a crypto-friendly country.

On the other hand, if Harris emerges as the winner, some believe that the price of Bitcoin could fall to $30,000 because of her stand on the cryptocurrency is not as clear as that of Harris.

There is the involvement of crypto-backed political action committees in this election cycle. They have amassed over $202 million to fund the 2024 elections; the largest PAC, Fairshake, has $177.8 million and spending $70.8 million so far.

Pre-debate national polls indicate that Harris is ahead of Trump by a margin of 2.7 percentage points, which could be attributed to the voters’ general apprehension concerning the economy, inflation, and immigration, and not necessarily the crypto.

Since the debate is now over, the focus will be on how the positions of the candidates change and how this may impact the political and crypto markets in the future months.

Also Read: MAGA Coin Price Drops 10% After Heated Trump-Harris Debate