Solana (SOL) recently hit a milestone of 75 million active addresses, a huge growth in its blockchain activity. At the same time, Solana’s price is struggling to break past the $132 Solana to USD resistance level, with the market watching closely for any further developments in the crypto world.

In this article, we’ll explore Solana’s news and achievements, its price trends, and what the future holds for this blockchain network.

Solana’s Growth: Reaching 75M Active Addresses

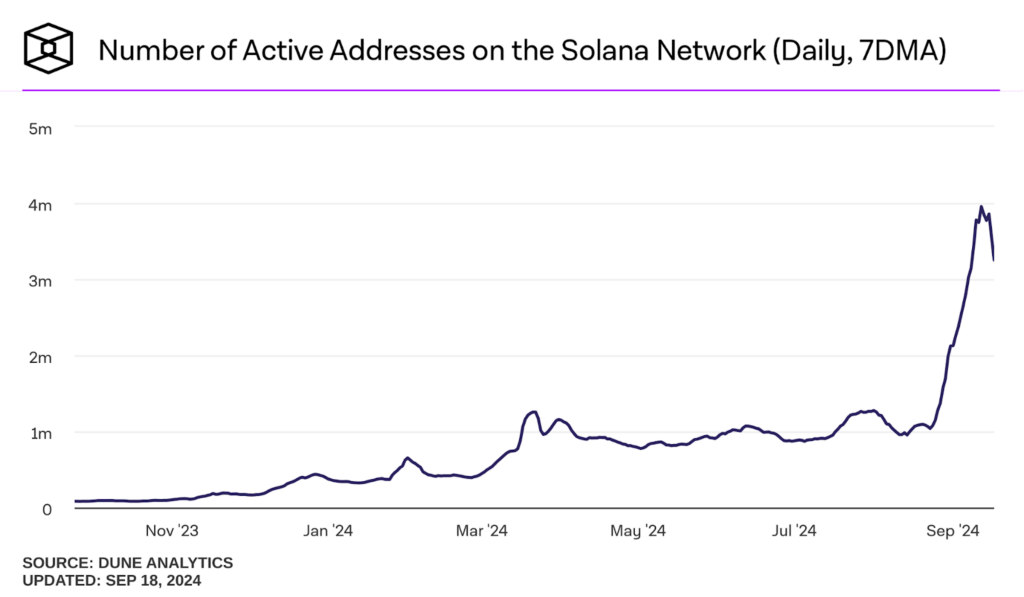

In September 2024, Solana broke the 75 million active addresses mark, setting an ATH for the network. It’s a big leap in user activity, with the Solana blockchain seeing a rapid expansion of dApps, NFTs, and DeFi projects. In just a few months, Solana saw exponential growth, with its monthly active addresses rising from 40 million in early 2023 to 75.2 million by mid-September.

If you’re a newbie, you might be wondering: what is Solana? It’s a fast, cheap blockchain network, which makes it a popular choice for developers and users.

Developers and users keep flocking to the Solana ecosystem. This rise in network activity has cemented its position as one of the top blockchains in the world. In addition to DeFi and NFTs, the Solana token is also widely used for staking and participating in governance, which has increased the demand for SOL. Analysts suggest that this surge in activity could push the Solana price USD higher in the near future.

SOL Price Resistance: Challenges at the $132 Mark

Despite the network’s growth, the Solana price is currently battling resistance at $132 and $140 after that. Over the past week, SOL has tested this price level multiple times, but each attempt to break above has been met with significant selling pressure. At the time of writing, SOL is priced at $129.39, reflecting a 2.06% drop in the last 24 hours.

The Solana price prediction indicates that the next major support level is at $120, with resistance near $132.50. If SOL fails to break through this level, the price could drop further, potentially testing the $120 support again. Solana’s recent transaction volume also shows bearish momentum, with $121.31K in short liquidations and $3.19M in long liquidations over the past 24 hours, suggesting increased volatility.

However, crypto Solana remains one of the strongest players in the crypto market, and many holders believe that once the $132 resistance is breached, the price could rally towards $140 or higher. Additionally, Solana’s increasing network adoption could play a significant role in future price movement. For holders, the price is a critical metric to monitor closely as it reflects Solana’s performance against major currencies.

Impact of Solana’s Address Milestone on SOL Price Trends

The milestone of 75 million active addresses has added to the bullish sentiment surrounding Solana, though it hasn’t yet translated into a significant upward movement for the price. The Solana USD pair shows that Solana’s value is closely tied to market sentiment, and analysts are keeping a close eye on liquidity and volatility data.

A potential breakout above $132 could bring Solana into a new bullish cycle, with targets around $140-$150. However, if Solana continues to face downward pressure, the price could fall below the $129 level, as suggested by the Solana prediction. The MACD indicator recently showed a bearish crossover, reinforcing the possibility of further declines if the current momentum persists.

This blockchain has shown resilience in the past, and with 75 million active addresses, the long-term outlook stays positive. The Solana coin has proven to be a favorite among institutional players, and its increasing usage in various dApps could catalyze future leaps.

Anyway, time will tell if Solana will reach new heights. While waiting for a rally, it doesn’t hurt to look at other promising options. The crypto community is currently abuzz with the Minotaurus ($MTAUR) presale. The $MTAUR tokens are priced low, and the growth path is clear during the stage of the token sale. With extra perks like vesting and referral programs, it might be a worthy addition to SOL portfolios.

The future of Solana still is optimistic despite short-term challenges at the $132 level. With 75M active addresses, the network is growing rapidly, and its impact on the market keeps on deepening. As the ecosystem matures, SOL has the potential to overcome its current resistance and reach new highs.