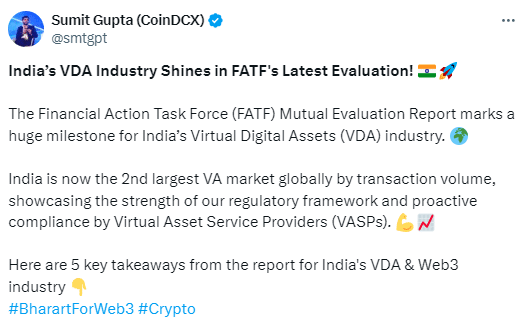

India has now emerged as the second-largest virtual asset (VA) market in the world by transaction volume, highlighting the effectiveness of its regulatory framework and the proactive compliance efforts of Virtual Asset Service Providers (VASPs).

To strengthen its defenses against cybercrime, India has implemented several initiatives in response to a recent report from the Financial Action Task Force (FATF). This report emphasizes the growing threat of cyber-enabled fraud and the complexities surrounding cryptocurrency, urging the need for robust cybersecurity measures.

Indian Virtual Asset Service Providers (VASPs) are making significant progress in adhering to AML (Anti-Money Laundering) and CFT (Counter-Terrorist Financing) regulations. They are implementing enhanced customer due diligence (CDD) and adopting innovative identity verification techniques.

Despite being new to the regulatory framework, Indian VASPs are excelling in preventive measures like collecting customer information, employing Travel Rule solutions, and conducting enhanced due diligence, strengthening global crypto compliance efforts. India’s authorities and VASPs are gaining recognition for their advanced approach to mitigating money laundering (ML) and terrorism financing (TF) risks, signaling their readiness for more sophisticated regulatory phases.

The Indian Cybercrime Coordination Centre (I4C), established in 2020, is leading the charge by developing advanced tools to aid law enforcement in tackling cyber threats. Financial institutions across the country are also enhancing their cybersecurity, using technologies like machine learning and geofencing to monitor risks.

Notably, 18 out of 28 Indian VASPs have adopted the Travel Rule, aligning with global best practices for secure and compliant external transfers of digital assets.

Despite these advancements, VASPs face challenges such as identifying counterparties and adhering to varying data protection laws. To combat these issues, they are adopting enhanced controls like video KYC processes for high-risk clients.

Following the FATF’s June plenary meeting, a report categorized India under “regular follow-up,” placing it among an exclusive group of only five G20 nations, showcasing India’s growing leadership in crypto regulation.

As India continues to strengthen its cybersecurity and regulatory landscape, these efforts are crucial for maintaining the integrity of its financial system and aligning with international standards.

Also Read: India Ranks 1st in Global Crypto Adoption Index: Chainalysis