The United States Securities and Exchange Commission (SEC) has approved Nasdaq to list options for BlackRock’s iShares Bitcoin Trust ETF trading under the ticker IBIT. This decision, announced on September 20, enables options trading for the ETF like other ETFs.

According to the SEC’s notice, options on IBIT will be physically settled and will follow American-style exercise rules. Nasdaq emphasizes that options on IBIT must meet specific standards, ensuring that the underlying security is widely held and actively traded.

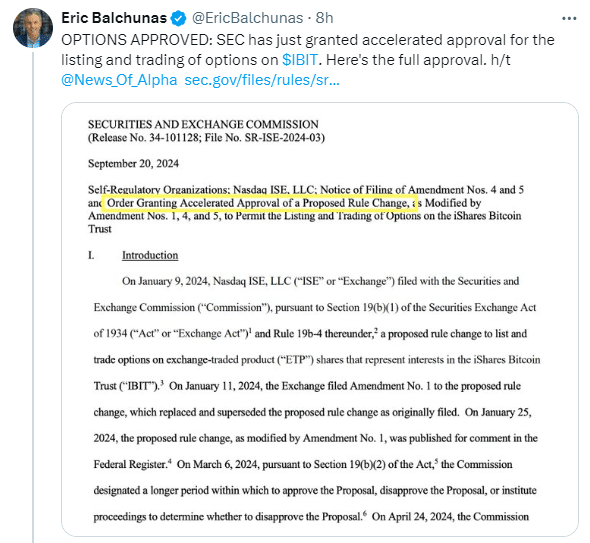

Bloomberg ETF analyst Eric Balchunas shared his thoughts on social media, suggesting that more approvals for options trading on spot Bitcoin ETFs may be coming soon.

However, he noted that the Office of the Comptroller of the Currency (OCC) and the Commodity Futures Trading Commission (CFTC) also need to give their approval before trading officially begins. The timeline for their decisions is uncertain.

In August, the trading volume for the IBIT Bitcoin ETF exceeded $875 million, contributing to a total of over $1.3 billion for all spot Bitcoin investment vehicles.

Nasdaq is also seeking SEC approval to allow options trading for spot Ethereum ETFs, indicating growing interest in cryptocurrency-related financial products.

This approval marks a significant step in expanding trading opportunities for Bitcoin investors and highlights the increasing acceptance of digital assets in traditional finance.

Also Read: BlackRock Launches Ethereum ETF on Brazil’s B3 Exchange