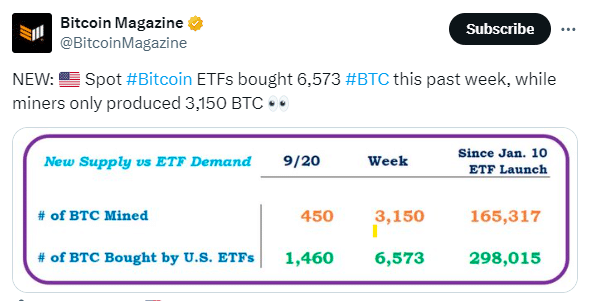

In a notable trend, spot Bitcoin exchange-traded funds (ETFs) bought 6,573 BTC in the last week, while miners only generated 3,150 BTC. This considerable imbalance is making Bitcoin’s already restricted supply even more rare.

Bitcoin is capped at 21 million coins, with the last one expected to be mined by 2140. As new cryptocurrencies flood the market, many with inflated supplies, Bitcoin remains unique due to its scarcity.

This scarcity is getting more noticeable with institutional investors joining the fray, particularly after the recent approval of Spot Bitcoin ETFs in the U.S. The approval has drawn both retail and large institutional players, which has notably increased demand for Bitcoin.

In the 7 days, Bitcoin’s price surged by 9% to achieve $64,518. At the moment, it is valued at $64,022.38, with a trading volume of $25.85 billion and a market cap of $1.26 trillion. Analysts foresee a continuing increase in prices as ETF issuers purchase more Bitcoin than miners are producing.

According to Bloomberg analyst Eric Balchunas, major issuers like BlackRock could be holding three times their current Bitcoin reserves by the end of next year. When investors purchase shares in these ETFs, issuers must buy matching amounts of Bitcoin, thus increasing the supply-demand.

With institutional investors typically needing up to a year for risk assessments, these ETFs are likely to see more capital soon. This persistent demand might cause intriguing changes in Bitcoin prices in the coming future.

Also Read: SEC Approves Options Trading for BlackRock’s Bitcoin ETF