In a surprising turn of events, Bitcoin (BTC) ended its six-day winning streak on Monday, declining by 0.37% to close at $63,349. This shift came despite the broader cryptocurrency market gaining 0.51%, raising the total market capitalization to $2.177 trillion.

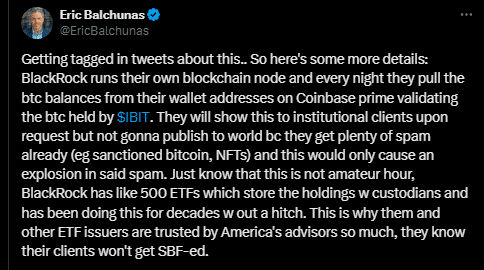

Adding to the buzz, BlackRock announced a new policy requiring Coinbase to process Bitcoin withdrawals within 12 hours. This move is part of BlackRock’s recent amendment request to the SEC, indicating their commitment to efficiency in digital asset management. The company has also been under scrutiny regarding rumors of acquiring paper BTC.

Bloomberg Intelligence analyst Eric Balchunas provided clarity, stating that BlackRock manages its assets with care, ensuring transparency and reliability in its operations. He emphasized that their ETFs are trusted and maintain a strong track record.

The US Bitcoin-spot ETF market faced challenges as Grayscale Bitcoin Trust reported net outflows of $40.3 million, while Fidelity’s Bitcoin Fund saw modest inflows of $24.9 million. Overall, the ETF market experienced a dip, with several issuers reporting zero net flows.

On the regulatory front, all five SEC Commissioners are set to testify at a hearing on September 24, with lawmakers eager to discuss the future of digital assets. Any shift in the SEC’s stance could significantly impact Bitcoin demand.

As investors look to the US economic calendar, consumer confidence figures may also play a role in influencing BTC demand. Economists predict an increase in the CB Consumer Confidence Index, which could indicate higher consumer spending.

Also Read: Spot Bitcoin ETFs Buy Double Mined BTC, Price Gain by 9%