The U.S. Commodity Futures Trading Commission (CFTC) is increasingly scrutinizing offshore crypto betting platforms, including Polymarket. During a July 17 discussion at Georgetown University’s Psaros Center for Financial Markets and Policy, CFTC Chair Rostin Behnam announced that the agency is closely monitoring platforms offering services to U.S. customers without proper registration.

The U.S. CFTC is closely monitoring Polymarket as the U.S. Presidential elections approach. Recently, Kamala Harris has gained traction against Donald Trump in the betting stakes on Polymarket.

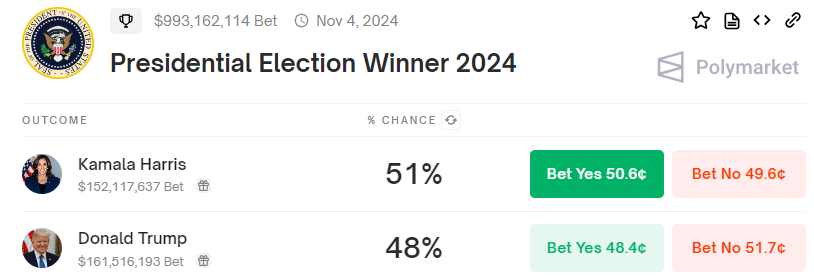

Currently, Polymarket shows Kamala Harris leading the 2024 presidential election odds at 51%, while Donald Trump trails closely at 48%.

This situation has caught the attention of the CFTC, which is facing scrutiny over allegations of market manipulation on offshore betting platforms.

CFTC Chair Rostin Behnam expressed concerns about the implications of regulating these platforms and the public’s desire for federal oversight of elections. While betting markets like Polymarket, PredictIt, and the upcoming Kalshi can reflect public opinion more quickly than polls, they also raise ethical questions about their impact on the political landscape.

SEC Tackles First Crypto “Pig Butchering” Scam

On Sept. 17, the U.S. Securities and Exchange Commission (SEC) filed its first case against a crypto “pig butchering” scam. The SEC sued five entities and three individuals connected to fake exchanges, CoinW6 and NanoBit, accusing them of defrauding investors of $3.2 million. These scams involve gaining trust through social media, leading victims to invest in fake crypto ecosystems displaying false information.

Also Read: CFTC Partners with Agencies to Combat Crypto Pig Butchering