China, the second-largest economy, has been grappling with a slow economy for a while now due to uneven industrial output outstripping domestic consumption. The country that has operated the investment-led model for years is experiencing a property downturn and increasing local government debts, leading to depressed investor confidence. Although strong Chinese exports have helped somewhat, growing trade tensions are now a worry.

Today, China introduced a monetary stimulus package to help the slowing economy.

The stimulus is geared towards injecting liquidity into the economy, thereby making the country economically strong. According to the news, the People’s Bank of China has reduced the amount of capital that can be held by banks. This has not been done since 2018.

To achieve the country’s objective, the stimulus package was unveiled,covering intentions to cut the outstanding mortgage rate for individual borrowers by an average of 0.5%, which is closely $5.3 trillion, thereby reducing rigidity on second-home purchase rules. Finally, the People’s Bank of China Governor Pan Gonsheng added that the central bank will make available 8000 billion yuan ($133 billion) in liquidity support to kickstart and ensure achieving a stable market.

Implications of the stimulus package

China’s move to ensure recovery and a stable economy will have several impacts on the country and globally, some of the impacts, both good and bad could include, but are not limited to

Inflation Concerns

While China moves are commendable, the stimulus measure could result in inflation concerns, especially when there is too much liquidity and consumer spending, thereby driving up prices of goods in the market and further increasing inflation pressures.

Economic Growth

According to the statement made by Pan, the measures are geared towards ensuring economic growth, which will positively impact businesses, encourage consumer spending and rekindle investors’ confidence in China’s economy as well as rates.

Global Impact

China being the second-largest in the world impacts the global market. Therefore, if the monetary stimulus package improves China’s economy, it will eventually impact the country’s trade and export activity, thereby supporting global economic growth.

Impact on Crypto Industry

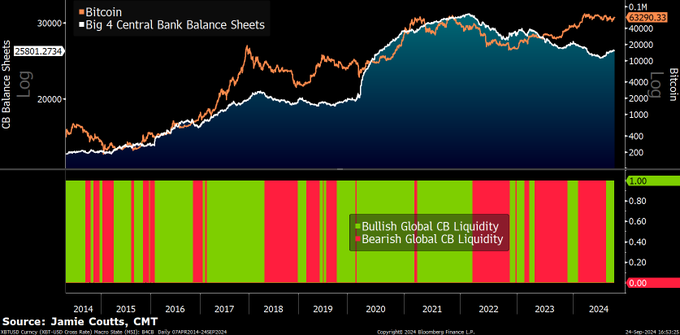

With China’s recent offer of economic stimulus, the largest cryptocurrency in the world, Bitcoin, is expected to see a significant uptick in value towards $78,000. It is worthy to note that the price of Bitcoin quickly increased after the Fed reduced rates in September, rising to $64,000. According to the technical chart, Bitcoin is strengthening and could soon reach a new all-time high.

Commenting on the China stimulus package, according to Jamie Coutts, the head cryptocurrency analyst at Real Vision, an investment management company, says that the recent stimulus package from China is good news for Bitcoin since it will likely lead other central banks to do the same.

Curiously, the direct relationship between Chinese liquidity and Bitcoin is less evident now that China has banned cryptocurrency mining in 2021.

But as Coutts said, the performance of Bitcoin is still strongly correlated with the state of global liquidity, and China’s relaxing policies may lead to more significant changes in risk appetite.

Additionally, financial markets have responded favorably to the measures, with Asian markets hitting their best points in 2.5 years and Chinese equities and bonds surging. In relation to the US dollar, the Yuan has likewise reached its highest point in sixteen months.

The goal of the PBoC’s stimulus programs is to create economic liquidity, which may encourage more speculation in a range of asset classes, including cryptocurrencies. Investors may withdraw money from digital assets while traditional markets are doing well, which could lead to brief price drops. On the other hand, if the yuan were to weaken, money might be drawn to cryptocurrencies as a substitute form of currency.

Conclusion

The present economic stimulus issued by China is all-inclusive and durable, looking to heat up the chilly economy of China. Monetary policy loosening, borrowing more, supporting real estate markets through favorable policies, and making consumers buy more are some of the things that will help the government in increasing economic activity and normalizing the economy.

All the series of policies will work only to the extent that these policies are well implemented and whichever way the external economy swings. The rest of the world is laughing as China attempts to boost its economy through stimulus measures, and this will obviously impact both Chinese and global economies.

Also Read: India Plans Massive Animation and Metaverse Push for Movies