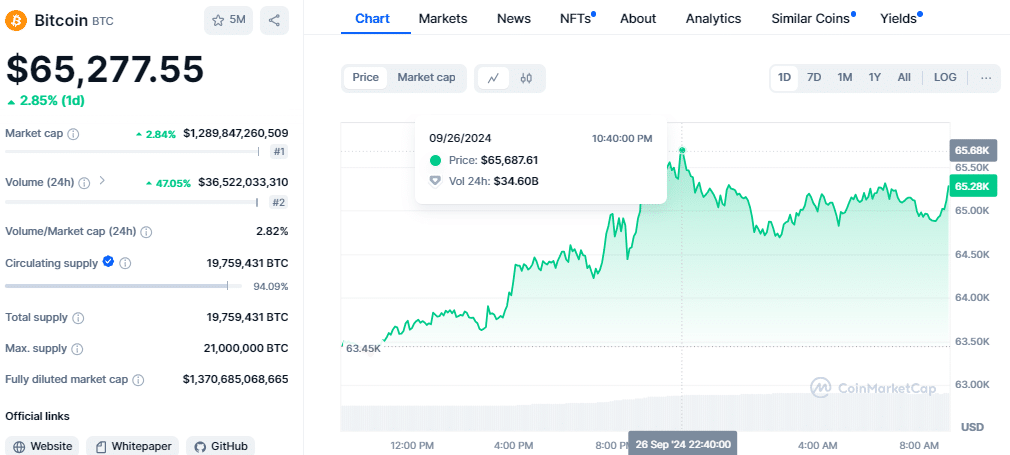

Bitcoin price has traded above $65000 for the first time in four weeks, touching $65687 on Thursday, a 3.7% gain. This surge comes just ahead of the expiry of over $5.8 billion in options contracts that some analysts have said could cause more volatility in the market.

Chris Newhouse, director of research at Cumberland Labs, pointed out that this price has been a resistance level for Bitcoin in August and September. “We’re retesting it,” he said, stressing that a breakout could lead to a rally, while a breakdown below $65,000 could lead to a selloff.

On September 27, the Crypto Fear and Greed Index reached 61, entering the “Neutral” zone for the first time since July 31, 2024, when Bitcoin was at $66,200. This also helped to rise Bitcoin’s price to $65,600 today.

It is not just Bitcoin that is causing the buzz. Other altcoins that also surged include Dogecoin which increased by 9%, Solana by 5%, and Avalanche by 6.5%.

About 20% of the Bitcoin contracts are in the money as traders get ready for the options expiration on Friday. Deribit’s CEO, Luuk Strijers, said that such a large expiry could impact the market since traders will be rebalancing their trades.

Darius Tabai, the CEO of Vertex, said, “The market should chop around ahead of expiries as gamma hedging takes control of the market around the 60 and 65k levels.”

On the other hand, there are talks about the regulation of cryptocurrencies since many investors are waiting for clearer rules that would improve the stability of the market.

Also Read: Could BTC Breakout & Hit $70,000 By September End? Bitcoin Price Prediction