Leading cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin, dropped in price on Monday as investors awaited Federal Reserve Chair Jerome Powell’s speech on potential interest rate cuts in the coming months.

Bitcoin, the largest cryptocurrency by market cap, has shown strong momentum and then slid 2.4%, while Ethereum has experienced volatility. Meanwhile, Dogecoin has struggled to maintain its value despite its dedicated community.

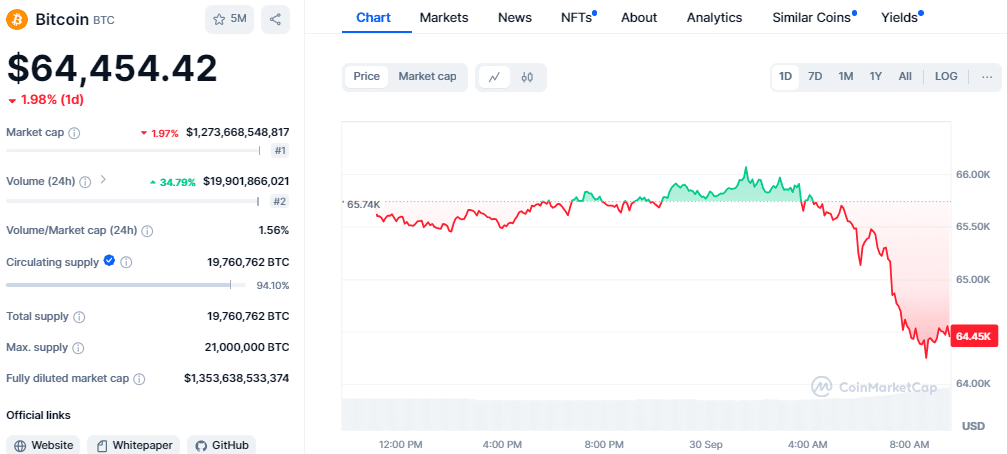

Bitcoin briefly surged above $66,000 before dropping to $64,200 overnight. Despite this dip, Bitcoin gained 8.90% in September, a notable rise compared to its historical average loss of 3.47%. This rally was driven by the Fed’s 0.5% rate cut earlier in the month.

Ethereum, trading around $2,600, also saw fluctuations. Large investors moved around $45 million worth of ETH, raising concerns among traders. Ethereum is currently priced at $2,620, down 1.88% in the last 24 hours.

According to CoinMarketCap, Dogecoin also saw a notable drop, falling 6.37% in the past 24 hours to $0.1211. Bearish sentiment and increased short positions have weighed on its price. Despite this, Dogecoin remains popular, driven by its loyal community.

In the past 24 hours, total cryptocurrency liquidations have surpassed $152.86 million, with long positions making up around 70% of the liquidations.

The total cryptocurrency market capitalization stands at $2.29 trillion, down 0.77% in the past 24 hours. Investors are closely watching Powell’s speech at the National Association for Business Economics later today for signals on rate cuts, which could impact the market’s direction as well as the U.S. non-farm payrolls report on Friday.

The current drop in Bitcoin, Ethereum, and Dogecoin reflects cautious investor sentiment ahead of key economic updates. Market participants are eager to see how interest rate cuts could impact cryptocurrency prices moving forward.

Also Read: The Future of Crypto: BTC Trends, MTAUR Market Explosion