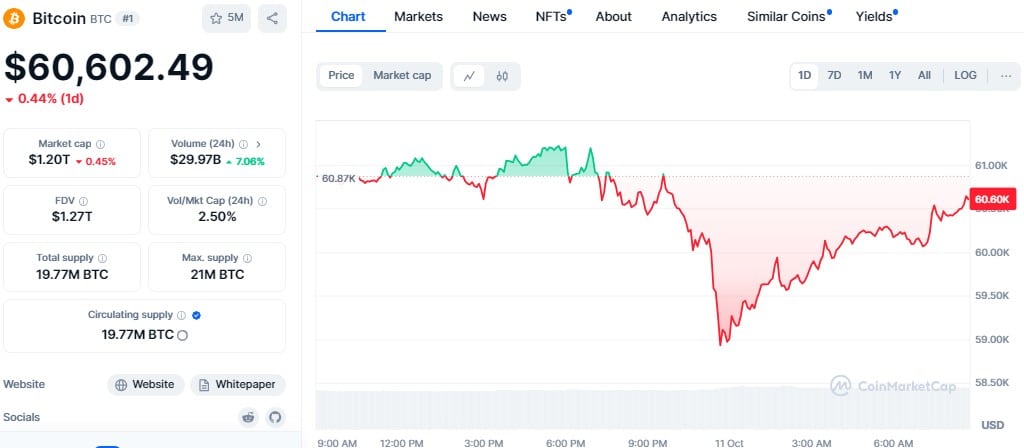

Bitcoin’s price dropped by 3% in the last 24 hours, reaching a three-week low of $58,900 after unexpected U.S. inflation data. This sparked concerns that the Federal Reserve might pause interest rate cuts. However, Bitcoin began to recover, gaining 2.84% and trading at $60,602.

The price decline triggered liquidations worth $196 million, affecting nearly 57,000 traders, according to Coinglass. Bitcoin’s long positions accounted for $67.18 million of those liquidations, while Ethereum traders lost $40.70 million.

This Bitcoin sell-off reflects investor fears of an economic slowdown. September’s Consumer Price Index (CPI) rose by 0.2%, raising concerns about stagflation, where prices rise despite a stagnant economy. Jobless claims also hit a 14-month high, with 258,000 people filing for unemployment benefits by October 5, according to CNBC.

Adding to the market’s bearish tone, Bitcoin ETFs saw two consecutive days of net outflows totaling $59 million, further dampening trader sentiment. Meanwhile, the U.S. SEC’s lawsuit against Cumberland DRW for allegedly acting as an unregistered dealer in cryptocurrency transactions heightened regulatory uncertainty.

Despite the bearish sentiment, there was a positive note as Metaplanet Inc. increased its Bitcoin holdings by purchasing nearly 109 BTC, valued at 1 billion yen. This brings its total Bitcoin assets to 748.502 BTC.

Traders have responded cautiously, with Bitcoin futures and options markets signaling reduced confidence. The futures premium dropped below the 3% neutral threshold, a worrying sign of bearish momentum that could lead to further downside pressure.

Also Read: U.S. Government To Auction $4.4B In Bitcoin From Silk Road!