Crypto exchange Bitnomial has filed a lawsuit against the U.S. Securities and Exchange Commission (SEC). The lawsuit challenges the SEC’s assertion that XRP futures are securities, a claim that has been a point of contention in the crypto community.

The SEC has long maintained that XRP, the digital asset associated with Ripple Labs, qualifies as a security. This classification has significant implications, as it subjects XRP and related financial products to stringent regulatory oversight. Bitnomial’s lawsuit argues that XRP should not be classified as a security, and therefore, its XRP futures contracts should not fall under the SEC’s jurisdiction.

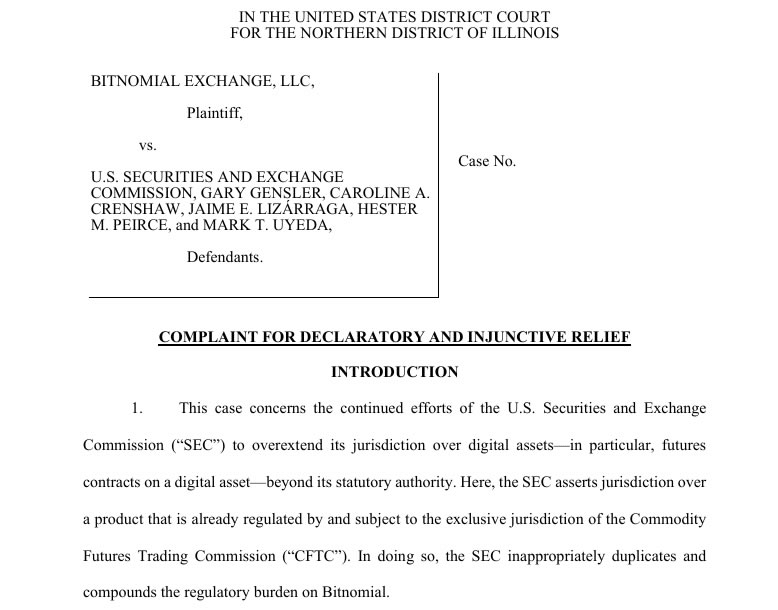

Bitnomial’s legal team contends in the lawsuit filed on October 10 that that the SEC is overstepping its authority by attempting to regulate XRP futures. They argue that XRP, like Bitcoin and Ethereum, should be considered a commodity rather than a security. This distinction is crucial, as commodities fall under the purview of the Commodity Futures Trading Commission (CFTC), not the SEC.

The lawsuit also highlights the ongoing jurisdictional battle between the SEC and the CFTC over the regulation of digital assets. Bitnomial hopes that this case will bring much-needed clarity to the regulatory framework governing crypto derivatives.

The outcome of this lawsuit could have far-reaching implications for the crypto market. If Bitnomial prevails, it could set a precedent that limits the SEC’s ability to regulate other digital assets as securities. This could lead to a more favorable regulatory environment for crypto exchanges and investors alike.

On the other hand, if the SEC’s classification is upheld, it could reinforce the agency’s authority over a broader range of digital assets, potentially leading to increased regulatory scrutiny and compliance costs for crypto businesses.