Bitcoin’s price skyrocketed above $64,000 early on Monday, October 14, reaching a peak of $64,109. This surge, marking a 2.1% increase in just 24 hours, brought Bitcoin back to levels not seen since September 30.

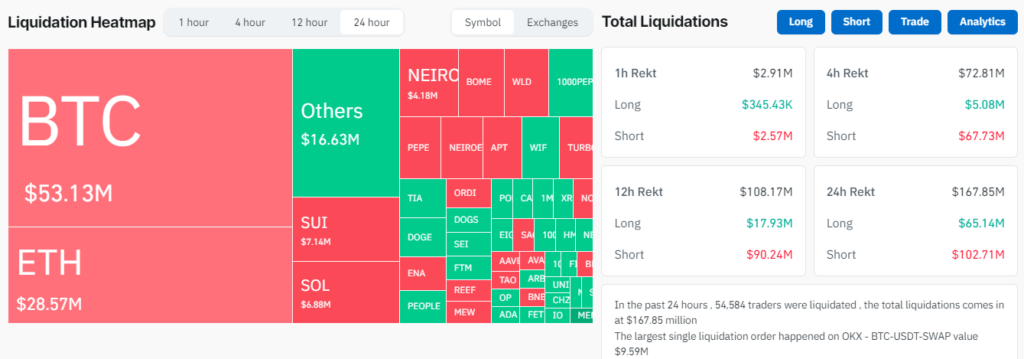

As Bitcoin rallied, the market saw a significant shake-up, with over $101.4 million in short positions being liquidated. Crypto derivative data analysis firm Coinglass reports 54,589 traders were affected, with the total liquidation amount exceeding $166 million.

Specifically, Bitcoin shorts accounted for $53.13 million, while Ether (ETH), which climbed to $2,540—a two-week high, saw $28.57 million in liquidations.

Bitcoin’s impressive gain pushed its market dominance back above 58%, close to its highest point since April 2021. October is known for its historical performance, with Bitcoin experiencing positive returns in nine of the last eleven years. This has led to speculation among analysts about a potential market rally, often referred to as “Uptober.”

While Bitcoin stole the spotlight, Ether also performed well, reclaiming the $2,500 mark with a 2.9% gain. Other cryptocurrencies, including Solana (SOL), which rose 4.4% to $151.02, and high-cap altcoins like BNB, XRP, and Dogecoin (DOGE), also saw slight gains.

Also Read: Google Removes Bitcoin and Crypto Price Charts from Search