The REEF token has experienced a big price fluctuation since its delisting from Binance spot trading on August 2, 2024.

The token initially surged over 650% in just 3 months from its lowest earlier this year, reaching $0.010. According to Wise Advice, a crypto influencer on X, retail traders started short-selling the token, while Whale bought it after the delisting.

However, after a recent peak, the price dropped sharply, losing 64% of its value. As of press time, the token is trading at $0.0042 with a 53% drop in market cap.

Despite the dump, the token has seen a massive 139% in total market volume in the last 24 hours to $235 million, largely fueled by trading from exchanges such as WhiteBit, HTX, KuCoin, and Bitget.

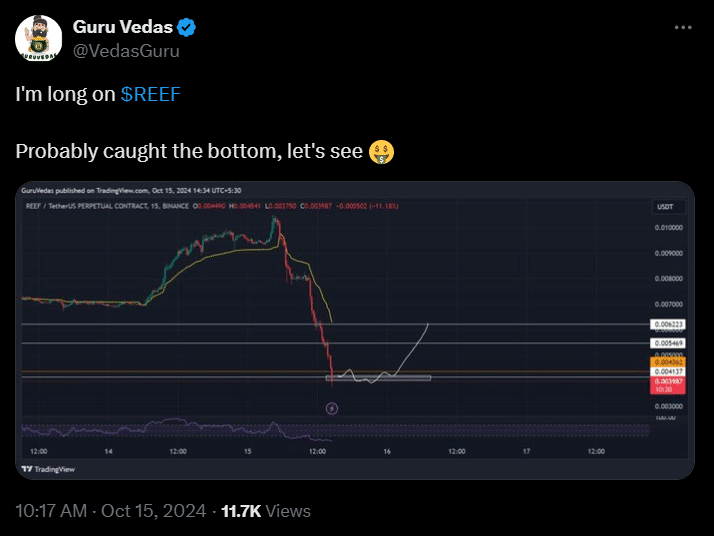

Moreover, the number of REEF token holders has also risen significantly, reaching nearly 23,000. While some see this dip as a “pump and dump” situation, some crypto analysts like Guru Vedas see the current price as an entry and expect a bullish trend soon.

Binance delisted the REEF due to “low trading volume and liquidity” and “regulatory requirements”, but developers behind the token have been actively working to revitalize the project.

They set up a community fund to support new ideas and applications, focusing on lending and decentralized organizations (DAOs). One exciting project is from Hydra Coin, which is creating the first NFT battle card game on the Reef Chain.

Additionally, the Reef project is also partnering with VIA Labs to enhance its bridging capabilities, aiming to improve interoperability within the blockchain space.

Also Read: JUP Surges 11% as Grayscale Considers it for Investment