Crypto futures trading gives investors access to deeper liquidity, advanced risk management strategies, and leverage to fund larger trades. It’s not for everyone, but for those looking to go beyond the basics, futures and crypto derivatives can be a powerful option.

Choosing the right platform is key to getting the most out of this strategy. You’ll want access to a wide selection of assets, low fees, and advanced order functions like TWAP. In this guide, we’ll cover the 5 best crypto futures trading platforms for 2024.

Read on to find out which one suits your trading needs.

Top Crypto Futures Trading Platforms for 2024

Here’s a breakdown of the 5 best crypto futures trading platforms for 2024:

- Bybit – Overall Best Crypto Futures Exchange

- OKX – Most Popular Platform for Futures Traders in Asia

- MEXC – Offers the Highest Leverage with up to 200X

- Binance – Good Option for Institutional Investors

- Hyperliquid – Best Decentralized No KYC Futures Platform

- Gate.io – Most Altcoin Futures Contracts (2,100+)

Review of the Best Crypto Futures Trading Platforms

Now, let’s break down the top crypto futures platforms in more detail, so you can choose the one that fits your strategy.

Whether you’re after deep liquidity, high leverage, or advanced automation tools, each platform offers something unique to suit different trading needs.

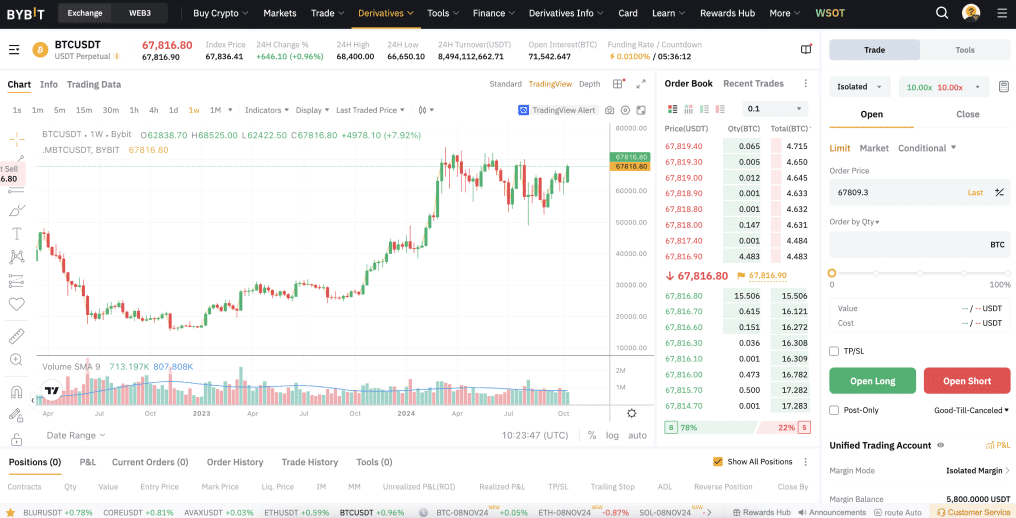

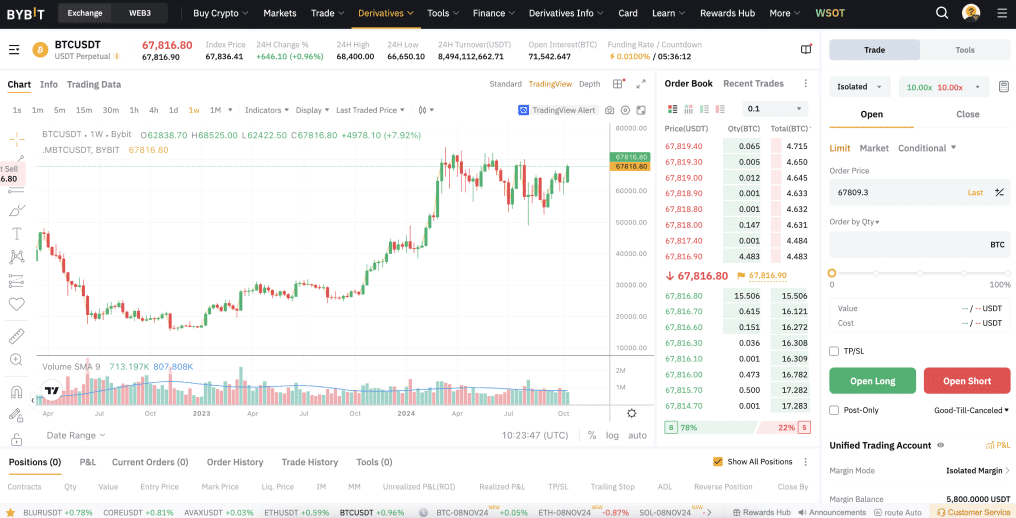

1. Bybit – Overall Best Crypto Futures Exchange

Bybit is a top-tier crypto futures trading platform, known for its deep liquidity, low fees, and advanced tools. Supporting over 1,500 cryptocurrencies and 300+ trading pairs, Bybit provides up to 100x leverage on perpetual and quarterly contracts. With over $60 billion in daily trading volume, it’s designed for serious traders needing reliable execution, even in volatile markets.

Bybit’s fee structure is highly competitive, offering a 0.02% maker fee and a 0.075% taker fee. It also features advanced order types, including limit, stop-loss, and take-profit, allowing for strategic trading. Security is a priority, with two-factor authentication, cold storage, and multi-signature withdrawals.

Key Highlights:

- 1,400+ cryptocurrencies and up to 100x leverage

- $60 billion+ daily trading volume

- 0.02% maker fee, 0.075% taker fee

- Advanced order types: limit, stop-loss, take-profit, TWAP orders

- Strong security: 2FA, cold storage, proof-of-reserves

- User-friendly across mobile (iOS and Android) and desktop

2. OKX – Most Popular Platform for Futures Traders in Asia

OKX, founded in Hong Kong and now based in Dubai, is the leading crypto futures platform in Asia, widely recognized for its deep liquidity and advanced trading features. Offering up to 125x leverage on over 300 cryptocurrencies, it’s ideal for traders across the continent looking for a robust platform to execute complex strategies with perpetual swaps, quarterly, and bi-quarterly futures.

OKX’s fee structure is highly competitive, with 0.02% maker and 0.05% taker fees, reduced for higher volumes. It supports advanced order types, including stop-limit and trailing stop, alongside automated trading through bots and copy trading. With strong security protocols like two-factor authentication, cold storage, and multi-signature wallets, OKX provides a secure and efficient environment for experienced traders.

Key Highlights

- 300+ cryptocurrencies with up to 125x leverage

- 0.02% maker, 0.05% taker fees

- Advanced order types: stop-limit, trailing stop, trigger orders

- Automated trading via bots and copy trading

- Strong security: 2FA, cold storage, multi-signature

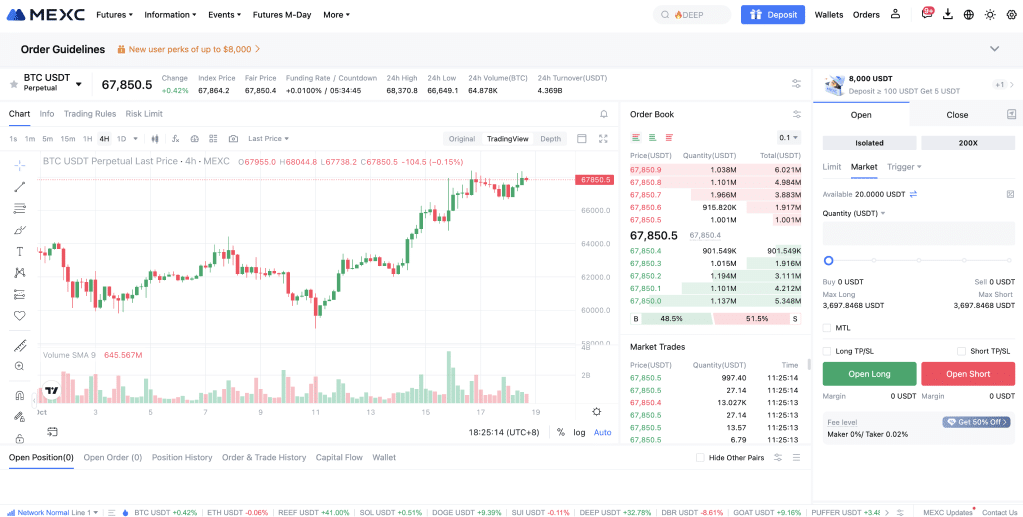

3. MEXC – Offers the Highest Leverage with up to 200X

MEXC, headquartered in Singapore, is the top platform for traders seeking high leverage, offering up to 200x on major assets like BTC and ETH. Ideal for those looking to maximize exposure with minimal capital, MEXC supports over 500 trading pairs, including major cryptocurrencies and altcoins, catering to high-risk, high-reward strategies.

The platform’s fee structure is competitive, with 0% maker fees and 0.01% taker fees, benefiting high-frequency traders. It also offers advanced risk management tools like stop-limit, trailing stop, and take-profit orders. With high liquidity, MEXC ensures smooth execution even in volatile markets, making it a strong option for seasoned and new traders.

Key Highlights

- Up to 200x leverage on select assets

- Over 500 trading pairs, including altcoins and major cryptocurrencies

- 0% maker fees, 0.01% taker fees

- Perpetual and quarterly futures contracts

- Advanced order types: stop-limit, trailing stop, take-profit

- High liquidity for reliable execution

4. Binance – Good Option for Institutional Investors

Binance is the top platform for institutional crypto futures trading, offering unmatched liquidity and advanced tools. With 416 futures contracts and $80 billion in daily derivatives volume, Binance provides deep order books and up to 75x leverage on major assets. It supports perpetual and delivery futures, allowing for precise strategic trading, alongside crypto options for popular tokens like BTC and ETH.

Fees start at 0.02% for makers, with discounts for BNB holders and volume traders, making it cost-effective for large trades. Binance’s advanced toolkit includes bots, copy trading, and market analysis, enabling precise execution at scale. The delivery futures feature, unique to Binance, adds further flexibility by settling contracts with actual crypto asset delivery.

Key Highlights:

- 416 futures contracts, up to 75x leverage

- 0.02% maker fee, with volume discounts

- Perpetual and delivery futures, plus options

- Advanced tools: trading bots, copy trading, market research

- Deep liquidity suited for institutional-scale trades

5. Hyperliquid – Best Decentralized No KYC Futures Platform

Hyperliquid, built on Arbitrum, is the leading decentralized perpetual futures exchange, offering top-tier liquidity and a smooth, KYC-free trading experience. With $2 billion in daily trading volume and support for 140+ cryptocurrencies, it’s designed for retail and institutional traders. The platform provides up to 25x leverage on large-cap assets like BTC, ETH, SOL, SUI, PEPE and others.

Capital efficiency on Hyperliquid is a standout, with 0.02% maker rebates (meaning you get paid a reward of 0.02%), 0.05% taker fees, and zero gas fees. Hyperliquid’s transparent on-chain order book also ensures secure and fair trades, while its integration with TradingView offers advanced charting tools.

Key Highlights

- 140+ cryptocurrencies, up to 25x leverage

- 0.02% maker rebate, 0.05% taker fee, zero gas fees

- Transparent on-chain order book for secure trading

- TradingView integration for advanced charting

- Points system for future governance token rewards

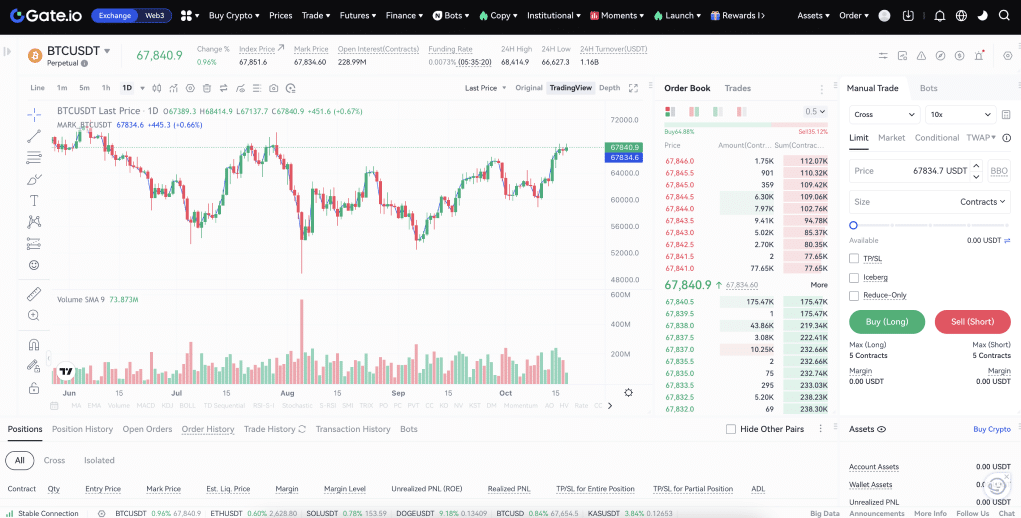

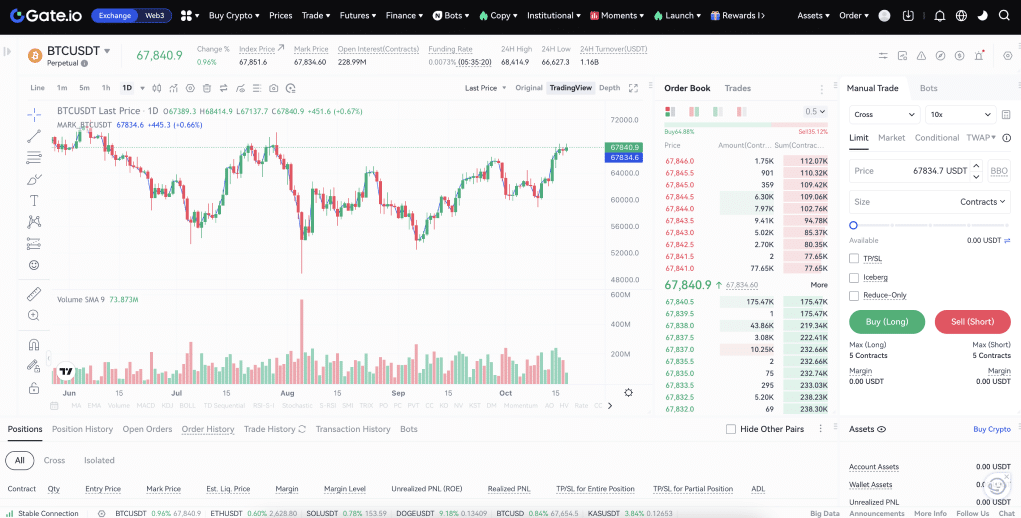

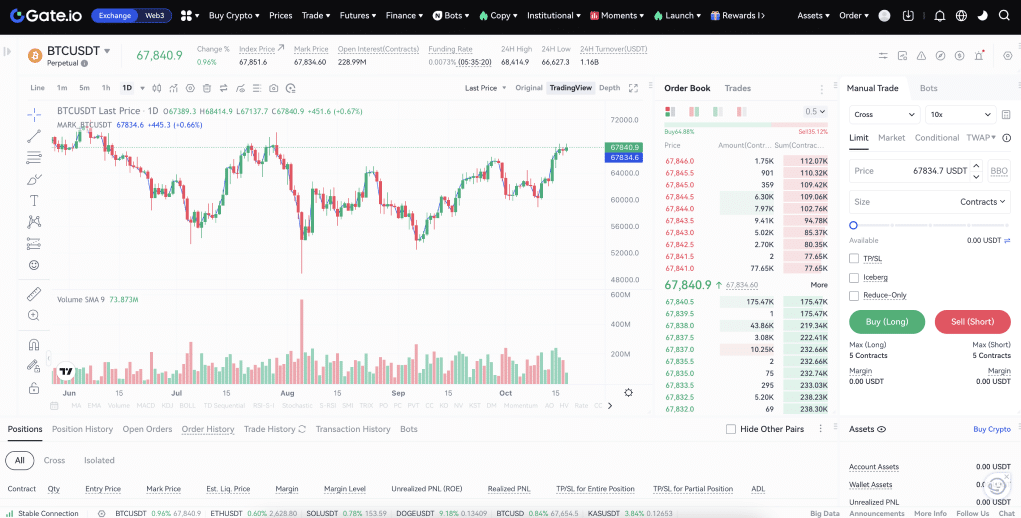

6. Gate.io – Most Altcoin Futures Contracts (2,100+)

Gate.io is the top platform for futures trading on altcoins, and it supports over 2,100 crypto assets. Whether you’re trading major assets or niche tokens, Gate.io offers unparalleled variety, making it the best choice for altcoin traders. With up to 100x leverage, it caters to both beginner and advanced traders looking to maximize exposure in the futures market.

Gate.io’s fees are competitive, with a 0.015% maker fee and a 0.05% taker fee. The platform also offers advanced tools such as stop-loss, take-profit, and trailing stop orders, allowing traders to execute complex strategies. Despite its extensive altcoin selection, Gate.io maintains high liquidity across pairs, ensuring smooth trading for large and small assets.

Key Highlights

- Supports 2,100+ altcoins for futures trading

- Up to 100x leverage on futures contracts

- 0.015% maker fee, 0.05% taker fee

- Perpetual and quarterly futures contracts

- Advanced order types: stop-loss, take-profit, trailing stop

- High liquidity across altcoin pairs for seamless execution

What is Crypto Futures Trading?

Crypto futures trading allows traders to speculate on the future price of a cryptocurrency by buying or selling contracts that settle at a predetermined price on a future date.

These contracts are standardized and traded on derivatives exchanges. Traders use them to hedge against price volatility or speculation, enabling them to profit from price movements without owning the underlying asset.

Futures contracts can be leveraged, allowing traders to control larger positions with minimal capital. However, this leverage amplifies both potential gains and risks, making it a high-stakes tool for experienced market participants.

If you are unfamiliar with leveraged trading, take a look at this website where they cover the topic in great detail.

How Does Crypto Futures Trading Work?

Crypto futures trading involves contracts to buy or sell a cryptocurrency at a fixed price on a future date. In practice, tokens are rarely exchanged. Instead, these contracts are traded purely as speculation on price movements, allowing traders to profit from volatility without holding the actual asset.

Most futures contracts are perpetual, meaning they don’t expire. Traders pay a funding rate to keep the contract open, ensuring the price stays aligned with the market. This allows for continuous speculation without dealing with ownership or settlement, making futures ideal for traders looking to maximize exposure without holding the underlying crypto.

Crypto Futures Trading Fees Explained

Understanding fee structures is essential for managing costs on crypto futures platforms. Here’s a breakdown of the main fees you’ll face:

Trading Fees

Trading fees are applied to each buy or sell order. “Maker” fees, for adding liquidity, are usually lower than “taker” fees, which apply to removing liquidity.

For example, Bybit charges 0.01% for makers and 0.07% for takers, while MEXC offers no maker fees, making it appealing for liquidity providers.

Funding Fees

Funding fees apply to perpetual contracts and are charged to balance the price with the spot market. Typically, fees are settled every 8 hours but can vary by exchange. The fee rate depends on market volatility and demand for the asset.

In certain conditions, traders may receive funding fees instead of paying them. Though funding fees are relatively standard across platforms, they still impact profitability over extended trades.

Deposit Fees

Crypto deposits are generally fee-free across most platforms. However, converting fiat to crypto incurs costs, ranging from 1% for bank transfers to over 3.5% for credit/debit card payments. Always factor this into your onboarding strategy.

Knowing these fees allows traders to better optimize their positions and minimize overhead on futures platforms.

Are Crypto Futures Trading Platforms Legal?

The legality of crypto futures trading platforms depends on your location. In regions like the USA, Australia, and Europe, crypto futures are regulated by authorities like the Commodity Futures Trading Commission (CFTC) in the U.S. and the European Securities and Markets Authority (ESMA) in Europe. These bodies ensure that platforms operate within legal frameworks.

However, some countries take a stricter stance. In the UK, for example, the Financial Conduct Authority (FCA) has banned crypto derivatives for retail investors, citing excessive risk.

Conclusion

Crypto futures trading allows for greater leverage, enhanced risk management, and deeper liquidity. Choosing the right platform is key to optimizing these advantages. From high leverage to advanced order tools and broad asset selection, the right platform can significantly enhance your trading strategy.

Understanding fees, regulatory frameworks, and platform features is critical to making informed, strategic decisions in this high-stakes market.