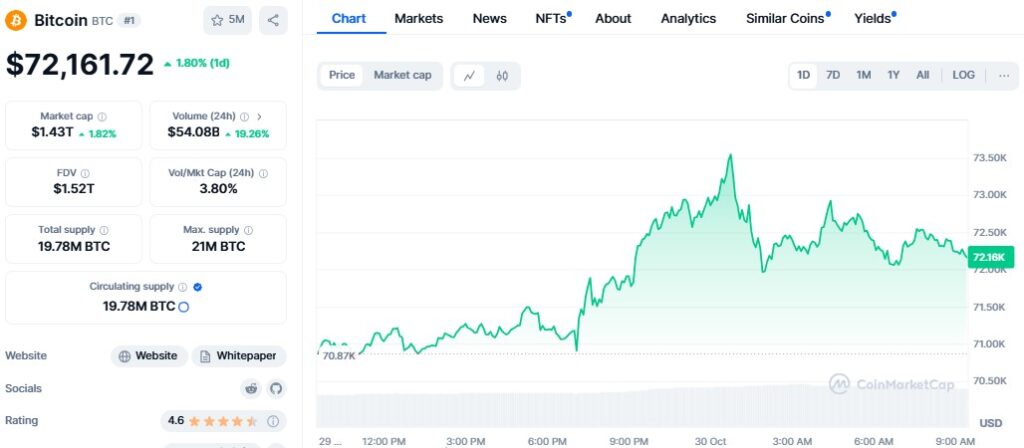

Bitcoin price jumped to $73,500 during U.S. trading on Tuesday, just below its all-time high. The record of $73,798 was set on March 14. This surge shows signs of a bull market, with several indicators suggesting Bitcoin could reach new highs.

First, Bitcoin has officially broken out of a seven-month downtrend. Its recent strong performance above the $68,000 mark has encouraged traders to pursue higher targets, with some eyeing ranges between $85,000 and $160,000, as noted by veteran trader Peter Brandt.

Second, Bitcoin’s price action has cleared significant sell walls in the $65,000 to $71,000 range, liquidating many short positions. This move has left short traders with losses, pushing bears to retreat.

Additionally, Bitcoin’s market dominance has climbed to 60%, the highest level since March 2021. This metric is often viewed alongside the Crypto Fear & Greed Index as a barometer of investor sentiment, with rising dominance indicating a potential bull run.

Open interest in Bitcoin futures has also surged to a new all-time high of $43.6 billion, reflecting strong interest from market participants. This uptick is seen as a positive indicator of investor sentiment as Bitcoin approaches its all-time high.

Moreover, the CME futures market has entered contango, with futures prices exceeding spot prices. This indicates growing interest in Bitcoin, as traders prepare for upcoming price movements.

Lastly, there has been a significant inflow into spot Bitcoin ETFs, totaling over $3.8 billion in the past two weeks alone. As of October 28, the total assets under management in these ETFs reached $68.5 billion, with expectations of further growth.

These factors combined suggest that Bitcoin is on the brink of a major breakout, potentially leading to new all-time highs.

Also Read: Bitcoin’s Bullish Rally Aims for $80,000 by 2025 End