Coinbase Global Inc. is expected to report strong revenue growth in the third quarter, possibly doubling compared to recent quarters which could bring the company back to profitability.

However, many investors are still cautious about Coinbase because fewer individual traders are buying and selling cryptocurrencies.

“Historically they come back later in the cycle,” said analyst John Todaro from Needham & Co. Inc., who has a “buy” rating on Coinbase, although he believes the data for the fourth quarter doesn’t fully show this trend yet.

According to Bloomberg report, shares in Coinbase have risen by about 27% this year, but this is much lower than Bitcoin’s 70% jump over the same period. The stock is also 40% below its peak from the crypto boom in late 2021.

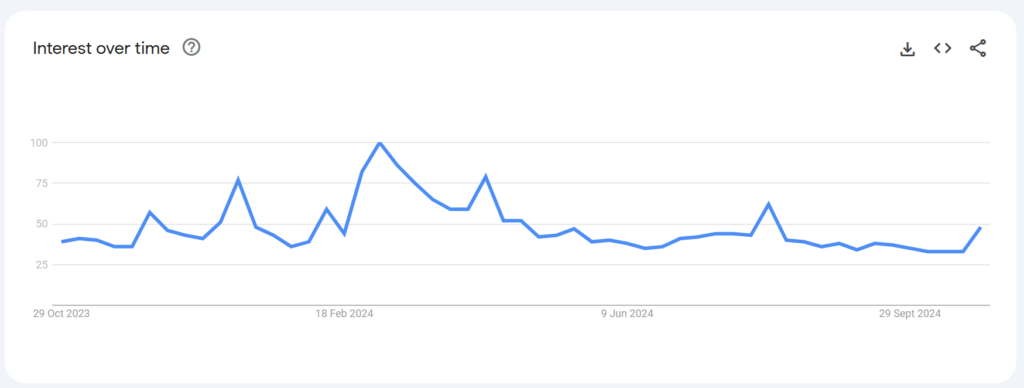

The dip in interest is partly due to fewer retail investors, who lost interest after Bitcoin’s price stopped climbing in March. Additionally, Google Trends data shows searches for “Bitcoin” are at their lowest point in a year.

Coinbase’s mobile app data also reflects this trend. The number of monthly users has dropped 6% over the past year, according to Sensor Tower. Meanwhile, Binance, the largest crypto exchange, saw a 20% increase in active users and a 94% rise in app downloads over the same period.

In addition, Coinbase’s market share in spot trading also dropped in the third quarter from 4.51% to 4.18%, while competitors like Crypto.com and Bybit gained ground by offering more tokens, according to data from CCData.

To reduce its reliance on retail trades, Coinbase has focused more on institutional trading and non-trading services, which now make up nearly half of its revenue. Nonetheless, some analysts remain cautious. Oppenheimer analyst Owen Lau expressed caution, saying, “it won’t be a good quarter for Coinbase.”

He believes conditions may improve after the U.S. presidential election, which could bring new crypto regulations that may benefit the company.

Also Read : Coinbase CEO offers wallet to AI influencer behind GOAT coin