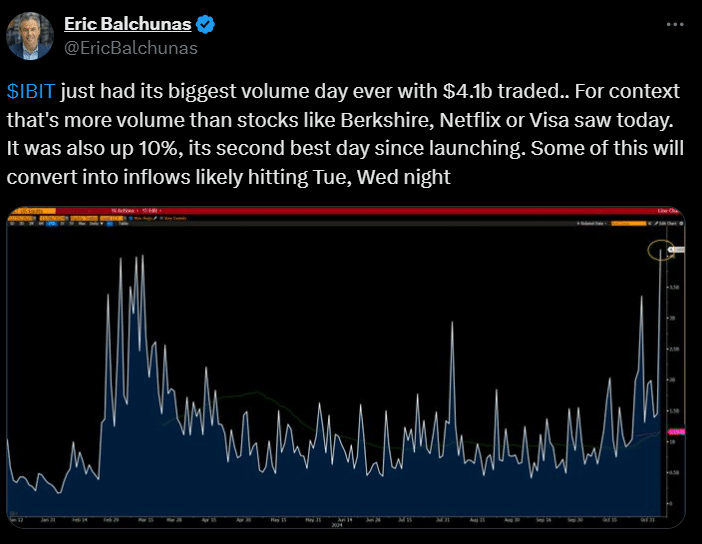

Yesterday, BlackRock’s iShares Bitcoin Trust (IBIT) saw its biggest day ever, with a massive $4.1 billion traded in a single day. This record-setting volume happened right after Donald Trump won the U.S. presidential election, which led to big excitement in the Bitcoin market.

According to Bloomberg analyst Eric Balchunas, IBIT’s trading volume was “more than stocks like Berkshire, Netflix, or Visa.” He also shared that $1 billion was traded in just the first 20 minutes of market opening.

The huge surge in trading made Nov. 6 the second-best day for IBIT since it launched in January. Trading on IBIT was up by 10% from previous days. Despite this, the fund saw $69 million in outflows, meaning that more people sold shares than bought them that day.

However, other major Bitcoin ETFs saw large inflows. Fidelity’s Bitcoin ETF, FBTC, led with $308.7 million in inflows, followed by ARK Invest’s ARKB with $127 million, and funds from Grayscale and Bitwise with over $100 million each. Total net inflows across U.S. spot Bitcoin ETFs reached $622 million, ending a three-day streak of outflows.

In total, U.S. Bitcoin ETFs saw $6 billion in trading volume yesterday, which was twice their daily average. Balchunas said this made it “an all-around banger day for an infant category that never ceases to amaze.”

ETF expert Nate Geraci from the ETF Store predicted that inflows could continue to rise, expecting net inflows across Bitcoin ETFs to pass $1 billion by the end of the week.

Bitcoin’s price also hit a new high, crossing $75,000 following Trump’s victory over Kamala Harris in the election. Trump, who is in favor of crypto, has promised changes that could help the industry, including replacing the SEC Chair, forming a crypto advisory council, and supporting U.S. Bitcoin mining.

International markets, however, reacted differently. Some of BlackRock’s iShares ETFs in Asia and South America saw drops. Analysts say this may be due to concerns over Trump’s trade policies, which could impact global markets.

Yung-Yu Ma, chief investment officer at BMO Wealth Management, noted that while things look strong for the U.S., “global markets remain particularly susceptible to tariff policy.”

Also Read: Bitcoin May Hit $100K Before Trump’s Inauguration: CNBC