Investment firm Bernstein believes it’s time for India to view Bitcoin as a strategic asset. With Bitcoin now worth $1.5 trillion globally and delivering an impressive 50% annual return over the last four years, Bernstein argues that India should not ignore its potential.

The firm argues that India’s regulators need to create a policy that treats Bitcoin not just as a “private currency” but as a valuable “store of value” in times of global economic uncertainty.

Bernstein suggests that Indian asset managers should step up to offer secure and regulated ways for people to invest in Bitcoin. Many Indian investors today face the risk of losing money on unregulated crypto exchanges, and Bernstein sees a chance for Indian companies to lead in creating safer investment options.

“Should Indian retail and institutional investors not gain access to regulated crypto products without risk of losing custody?” the firm questions.

In its report, Bernstein also highlights financial moves made by the United States, where Bitcoin is getting new attention. With crypto-friendly President-elect Donald Trump, who has big plans to make the U.S. a global leader in Bitcoin, the U.S. could soon treat Bitcoin as a strategic asset. Bernstein believes that as the world’s fifth-largest economy, India shouldn’t miss the chance to benefit from Bitcoin as well.

Currently, India’s government focuses on central bank digital currencies (CBDCs) and labels Bitcoin as “private crypto,” which Bernstein says limits its potential. The firm explains that the CBDC could help expand India’s digital economy, but it doesn’t replace what Bitcoin could do as “Digital Gold.”

Bernstein points out that India has significantly increased its gold reserves over the past decade, and it could do the same with Bitcoin without relying on foreign gold storage.

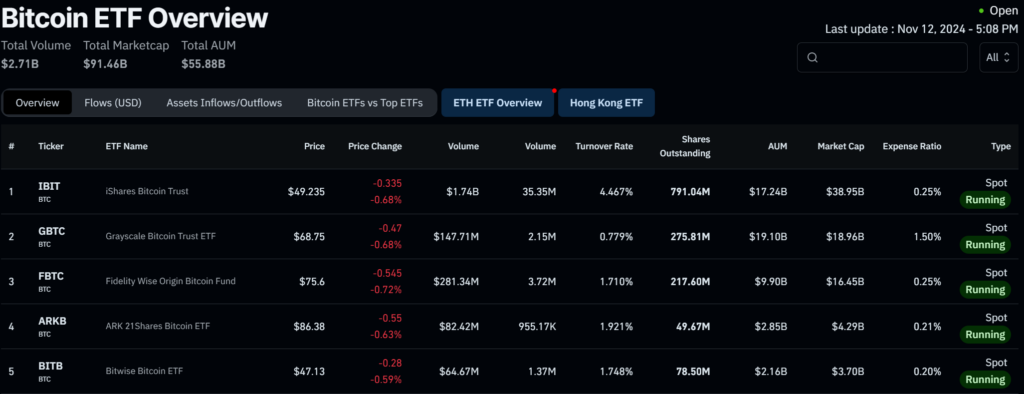

Globally, companies like Blackrock and Fidelity have already launched Bitcoin ETFs, bringing in over $55 billion in assets just 10 months after launch. Bernstein believes India’s leaders need to move fast on a Bitcoin policy.

“Crypto policy is complex and may take time to build consensus, but Bitcoin policy is urgent and of national strategic importance,” Bernstein stated.

The firm also encourages Indian tech and finance companies to work with regulators to offer Bitcoin through licensed platforms and protect Indian investors from risks like exchange hacks and fraud. This will give them a safe way to access Bitcoin, all while helping India keep up with global trends.

Also Read: Bitcoin Hits $89K, Sparking Extreme Greed in Crypto Market