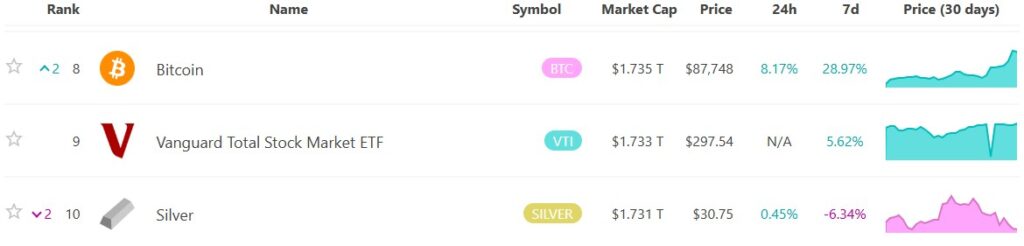

Bitcoin (BTC) has reached a new all-time high of $89,517, pushing its market capitalization to $1.735 trillion, surpassing silver’s $1.731 trillion. This marks a major milestone for cryptocurrency, securing its place as the world’s eighth-largest asset.

The surge in Bitcoin’s value comes as it briefly surpassed $89,000, reaching a peak of $89,517, before dipping slightly. This 9% increase in just one day is fueled by growing institutional interest and the continued demand for spot Bitcoin exchange-traded funds (ETFs).

Interestingly, Bitcoin has now overtaken silver twice this year, the first time being in March. Meanwhile, silver’s market cap has dropped by 6.24% over the past week, standing at $1.732 trillion, while Bitcoin has soared by 30% during the same period.

The move signals a shift in how traditional investors view Bitcoin, with growing recognition of the cryptocurrency as a stable store of value, much like silver—though still far behind gold, which remains over 10 times larger than Bitcoin with a $17.65 trillion market cap.

This rally is also linked to a shift in U.S. politics, where pro-crypto lawmakers are gaining traction. Investors are increasingly turning to Bitcoin as an alternative investment to traditional assets.

El Salvador’s Bitcoin investment has gained over $119 million in profit as Bitcoin hits a new all-time high of $89,500. Nayib Bukele tweeted, “I told you so,” expressing his confidence.

The “Bitcoin Industrial Complex,” which includes major players like MicroStrategy and Coinbase, saw a record $38 billion in trading volume, reflecting this growing confidence.

Bitcoin’s rise positions it just behind global giants like gold, Apple, and Microsoft, further solidifying its place as a serious asset for investors seeking diversification amid market uncertainties.

The future looks bright for Bitcoin as more investors flock to it for its potential.

Also Read: MicroStrategy Buys $2B More in Bitcoin at $74,463 per Coin