Bitcoin, the gold among cryptocurrencies, has surged to an unprecedented heights reaching $89,000 by Tuesday morning, buoyed by the recent victory of Donald Trump in U.S. presidential elections and an ongoing bull run. Technical analysts have predicted that BTC will break the $100,000 in 2024 itself as institutional and regulatory expectations have boosted post Trump win.

While there is a generic sense of euphoria around BTC’s surge, there is also a pertinent question troubling the newbies in crypto community, “Is it too late to buy BTC?”. From a trader’s perspective, it is always better to enter the market when BTC is at its lowest, but at this point, many are left wondering if it is indeed the best time to buy Bitcoin. To answer this question, here are a few things to look into for consideration.

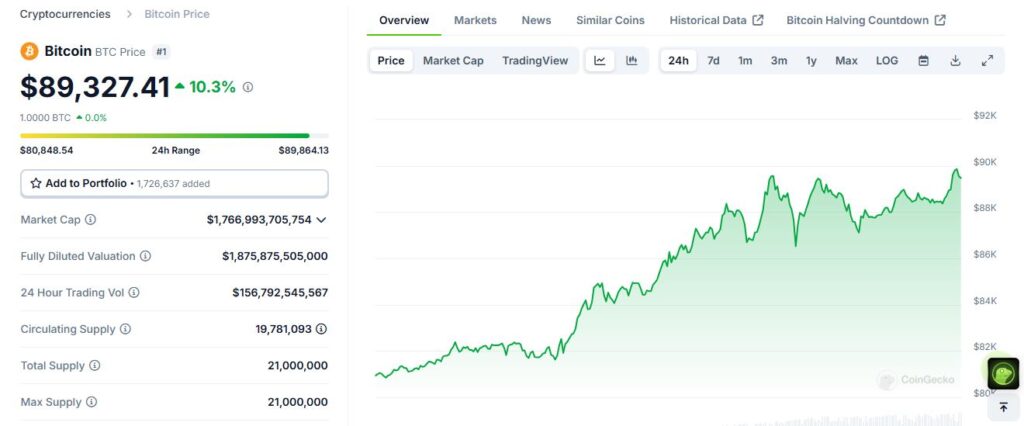

Current Market Situation

Recent reports reveal that the cryptocurrency Bitcoin crossed the $89,000 mark for the first time in its history.

Some of the factors responsible for driving high demand for Bitcoin are the massive institutional adoption, where companies and banks invest in bitcoin as a hedge against inflation and economic instability. In the same manner, expectations of favourable regulations and technological progress in blockchain have enhanced the optimistic mood in the market.

Expert opinion on Investing in BTC at $89,000

Different experts have different views regarding Bitcoin price prediction as well as investing in it, particularly with the recent jump to $89,000. The results of Finder’s surveys of crypto industry experts add that, in average, they see Bitcoin at almost $77,636 by the year’s close, with some of the estimates showing even greater figures of $125,000.

A number of the panelists highlight several aspects that justify such optimism, including the growing perception of Bitcoin as a safe asset in times of economic distress, period higher use of institutional investors, and the effects of regular “halving” that limit the number of Bitcoins generated.

However, in terms of investing, crypto investing expert Jan Van Eck said in a YouTube video, “It is better to act now before it is too late.” According to him, it is better to enter the market now because of BTC’s trajectory towards $100,000.

Long-Term Outlook for Bitcoin

Even though Bitcoin has recently spiked to 89,000, the long-term perspective for Bitcoin is still rather promising. This is because Bitcoin still has much room for expansion. First and foremost, we have seen Bitcoin’s legitimacy as an asset class reinforced through institutional buy-ins.

Figures like Tesla, Square, and MicroStrategy all have some quantities of Bitcoin on their balance sheets. Bitcoin-related investment products are becoming increasingly common in the offerings of major banks and other financial institutions. Such an interest will help ensure that the price and demand for Bitcoin will remain steady.

Thirdly, the narrative of Bitcoin becoming a hedge for inflation and fiat currency devaluation is strengthening. In light of the ongoing aggressive monetary policies pursued by central banks, the depreciation of fiat currencies is an attractive proposition, and Bitcoin is used as a means to achieve that. Furthermore, the 21 million cap on Bitcoin ensures that it will remain attractive as a deflationary asset.

Is it too late to buy BTC?

While it is not too late to buy BTC, at this point, it also comes with some potential risks. Except you are a high-risk trader, the following should be considered:

| Pros | Cons |

| Bitcoin has a hedge over inflation | Regulations might change and affect the market |

| Potential to reach above $100,000 | High volatility rsisk |

| Growing acceptance and increasing regulation to boost Bitcoin | ALternative investments might offer lower risks |

Conclusion

Finally, as the Bitcoin ecosystem continues to develop with technological innovations such as the Lightning Network, many are set to understand and embrace this currency, making mass adoption a reality. In addition, infrastructural advancements are expected to help configure the investment environment regarding Bitcoin investments.

Also Read: How to Buy Bitcoin for the First Time: A Beginner’s Guide