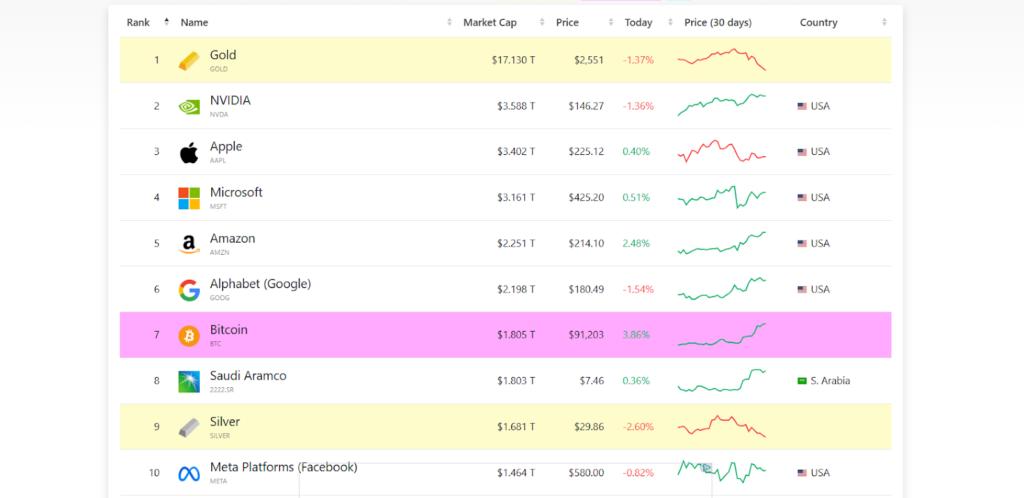

In an impressive move after the push above the $90,000 price mark, Bitcoin has ascended to become the world’s 7th largest asset by market capitalization. With this uptrend, Bitcoin has attained a market cap of $1.8 trillion to surpass oil giant Saudi Aramco.

Latest data shows that Bitcoin now trails only a handful of major global companies: Alphabet (Google), Amazon, Microsoft, Apple and NVIDIA to become the second largest asset after Gold. As Bitcoin continues its upward trajectory, investors and enthusiasts alike are speculating on what could lie ahead for the world’s first and largest cryptocurrency.

Bitcoin’s Meteoric Rise Amid a Bull Run

Over the past two weeks, Bitcoin’s price has surged tremendously with it largely driven by Donald Trump’s historic win in the U.S. Presidential Election of 2024. This bull run has not only boosted its market capitalization but has also reinforced Bitcoin’s standing as a contender in the global financial landscape. Bitcoin’s position above Saudi Aramco highlights its growing role as a store of value and its increasing appeal as a hedge against traditional financial markets.

This notable achievement for Bitcoin comes as traditional assets face mounting uncertainty, particularly as interest rates and inflation concerns have made equities and commodities more volatile. Amid this economic landscape, the anti-inflationary properties and decentralized nature of Bitcoin have attracted a diverse range of investors, helping fuel its recent ascent.

A Race with the Tech Giants: Can Bitcoin Catch Up?

Having surpassed Saudi Aramco, Bitcoin’s next immediate contender is Alphabet (Google) whose market capitalization is currently around $2 trillion. As Bitcoin inches closer to Google, the race becomes symbolic and reflects the growing competition between traditional tech giants and the emerging power of decentralized technology.

However, Bitcoin will still need significant momentum to surpass Google and other tech companies. Companies ahead in the list – including Microsoft, Amazon, Apple, and NVIDIA – are leading by significant margins and Bitcoin would need to push 2x of its current market cap to top.

Could Bitcoin Surpass Gold’s Market Cap?

The ultimate question for many Bitcoin enthusiasts is whether it could someday challenge gold’s long-standing dominance as the world’s premier store of value. Gold – with the market cap of around $17.13 trillion – is far ahead of Bitcoin’s current $1.8 trillion valuation. For Bitcoin to reach or exceed this milestone, it would need to undergo an unprecedented expansion with its price pushed to new unrealistic heights.

If Bitcoin were to increase tenfold with reaching approximately $850,000 per BTC, its market cap would be within range of gold’s valuation. Although such a scenario would likely require broader institutional adoption, mainstream embrace of Bitcoin as a global currency and a drastic economic shift that drives investors away from traditional stores of value toward digital alternatives.

While this may seem like a distant possibility today, Bitcoin’s rise in recent years demonstrates its potential to challenge long-held market conventions.

The Road Ahead for Bitcoin

Bitcoin’s ascent to the world’s 7th largest asset is not only a milestone but a reflection of how digital assets are reshaping the investment landscape. Its ability to continue climbing the ranks and potentially rival gold will depend on a combination of market forces, adoption rates and ongoing regulatory developments.

For now, Bitcoin stands as a testament to the transformative power of blockchain technology. It is challenging traditional financial models and sparking discussions about the future where money is decentralized.

As Bitcoin continues its climb, all eyes remain on the market’s next big moves. Whether or not it will reach gold’s towering market cap, Bitcoin’s current trajectory suggests that it is determined to close the gap with achieving one milestone at a time.

Keep Reading: Bitcoin Hits $93K, Closing in on $100K Milestone