As Bitcoin continues to surge and attain new highs, the inflows in spot BTC ETFs are also increasing as traditional players eyes for the most lucrative asset in finance markets. As of November 13, spot BTC ETFs have accumulated net inflow of over $4.7 billion in the past 6 trading sessions.

According to latest market data from Sosovalue, spot BTC ETFs have recorded one of the largest net inflows during past two weeks with the daily inflow amount exceeding $1billion on November 7 and November 11.

Both these past weeks have created a streak of 6 days in net positive inflow since 6th November when Bitcoin price started to accelerate from $75,000.

On November 13th, BTC topped and marked a new all-time high of $93,400 – as per data from Coinmarketcap. BTC price is currently trading around $90,500, up nearly 21% over the past 7 days.

Spot Bitcoin ETF Total Inflow Nears $100 Billion

While institutional interest in Bitcoin keeps growing, several traditional finance players are jumping into the boat via purchasing BTC via spot Bitcoin ETFs. Data from Sosovalue shows that total net assets in spot Bitcoin ETFs has reached $95.40 billion, merely $4.5 billion away from the historic speculation.

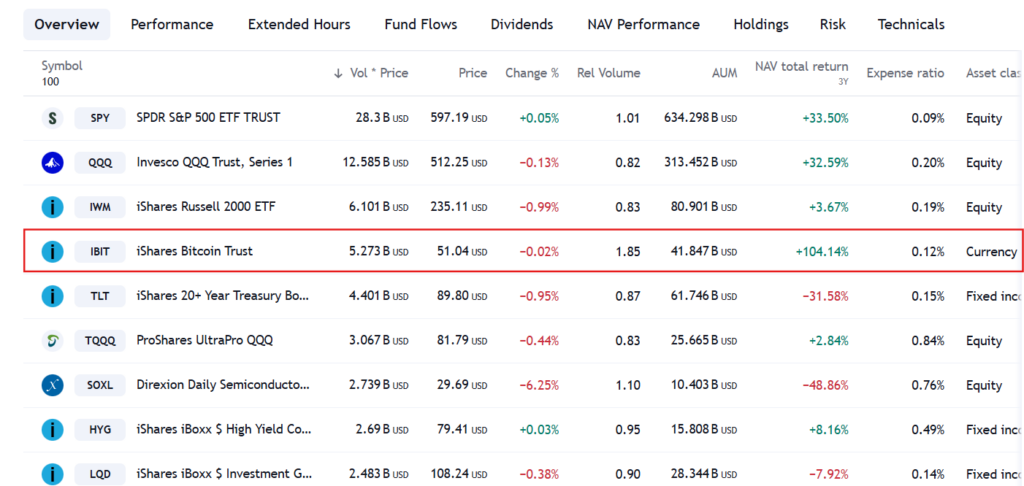

Since its launch in January, spot Bitcoin ETFs have accumulated billions of funds and have become increasingly popular ETFs (electronic exchange funds) for investors. BlackRock’s IBIT (iShare Bitcoin Trust) currently stands fourth among the most traded ETFs in entire finance markets.

The next week is expected to be more interesting for Bitcoin as its price keeps soaring and making new highs everyday. If the bullish run continues, BTC would most probably hit $100,000 by next week with the spot Bitcoin ETFs reaching and celebrating total net assets of $100 billion.

Keep Reading: Bitcoin Hits $93K, Closing in on $100K Milestone