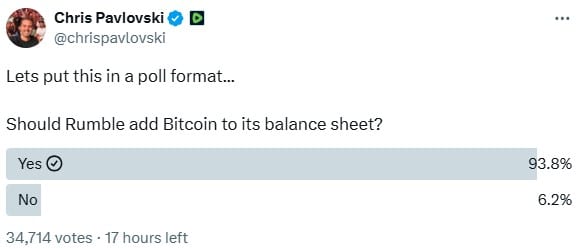

Rumble Inc (RUM) shares surged by 9% in after-hours trading on Nov. 19, reaching a high of $6.20. The spike came after CEO Chris Pavlovski asked on X whether the company should add Bitcoin to its balance sheet. The poll attracted 34,714 votes, with the majority saying “Yes.”

Prominent Bitcoin advocates quickly responded. Jack Mallers, CEO of Strike, offered help, while MicroStrategy Chairman Michael Saylor discussed strategies with Pavlovski. The excitement lifted Rumble shares, which had closed at $5.68 earlier, to $5.78 in after-hours trading.

Rumble, known for its lenient content policies, hosts 67 million monthly users and also provides cloud services to platforms like Truth Social. The company went public on Nasdaq in September 2022.

Rumble’s balance sheet shows $132 million in cash and securities as of Sept. 30, 2024. Its Q3 revenue grew 39% year-on-year to $25 million but fell short of analyst expectations, which had caused its shares to dip last week.

If Rumble adopts Bitcoin, it will join a growing list of firms embracing the cryptocurrency. Recently, Genius Group purchased 110 Bitcoin for $10 million as part of its “Bitcoin-first” strategy, while Japan’s Metaplanet bought $11.3 million worth of Bitcoin. Medical device maker Semler Scientific also boosted its Bitcoin holdings to 1,273 coins.

Rumble’s potential move into Bitcoin reflects the rising trend of businesses turning to digital assets as part of their financial strategies.

Also Read: Metaplanet’s Stock Climbs 15% After Buying 124 Bitcoins