Bitwise Asset Management registered a statutory trust for its proposed Bitwise Solana (SOL) ETF with the State of Delaware.

This filing, made through CSC Delaware Trust Company, suggests that Bitwise might soon file a formal application with the U.S. Securities and Exchange Commission (SEC) to launch the ETF.

Bitwise would still need to submit both an S-1 registration and a 19b-4 filing to the SEC for approval before the ETF can be officially listed.

But Bitwise is not the only one trying to get an approval. VanEck and Canary Capital also vying for a spot in the Solana ETF market. Although the trust has been registered, the SEC must still make a decision.

Once the ETF is launched, it will allow investors to gain exposure to the price movements of Solana’s native digital asset through traditional brokerage accounts. While the specific exchange and ticker symbol for the product hasn’t been revealed, Bitwise’s Bitcoin and Ethereum ETFs are currently listed on the New York Stock Exchange Arca, making it likely the Solana ETF could be listed there as well.

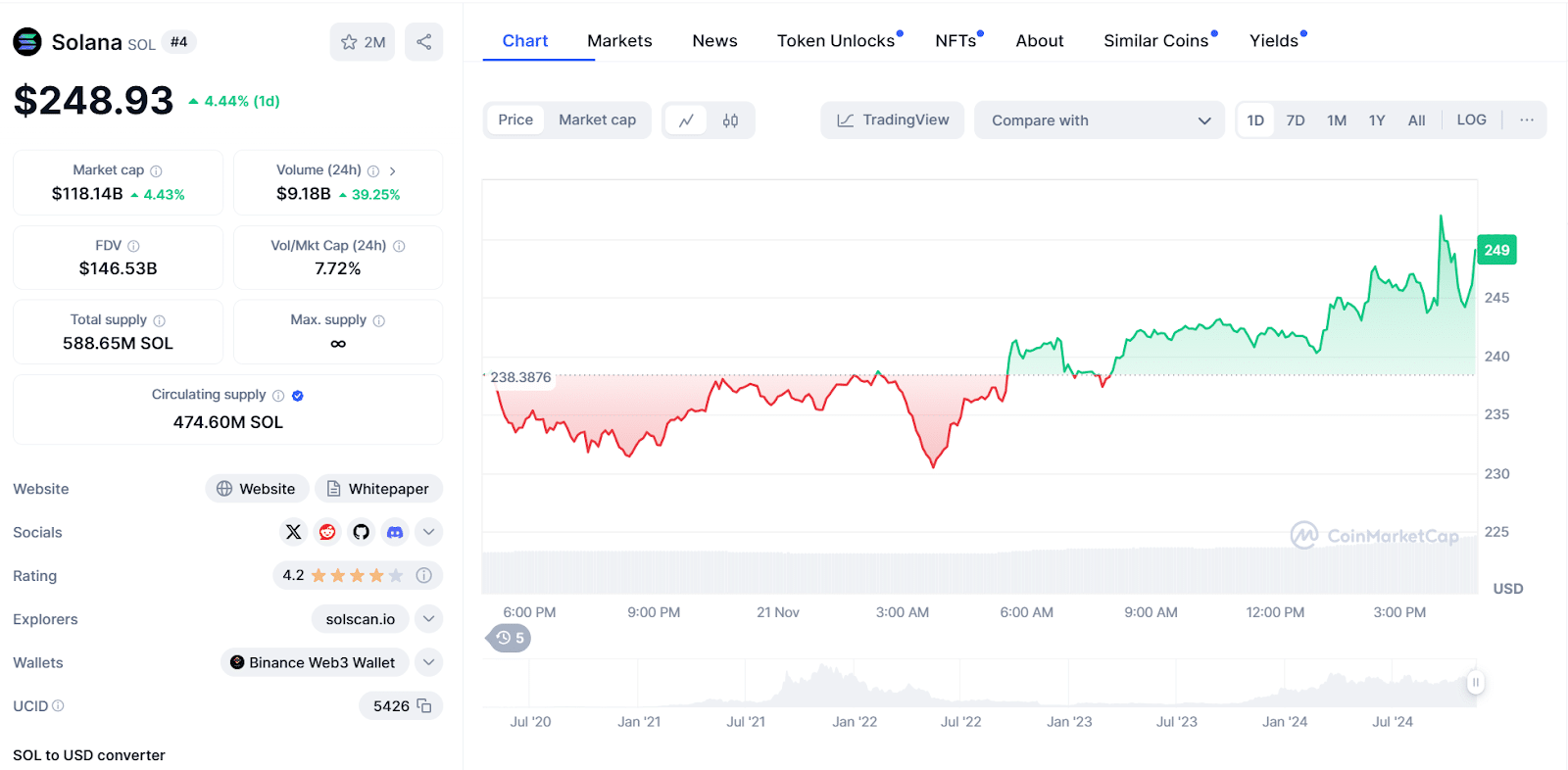

Solana itself has been doing really well lately, with its price jumping by more than 2,300% this year. The crypto recently surpassed Binance’s BNB token to become the fourth-largest cryptocurrency by market cap. This is part of the reason why firms like Bitwise want to launch an ETF around it.

As of now, the price of Solana stands at $248.93, reflecting a 4.44% increase in the past 24 hours. The crypto has also recorded a 4% rise in Market cap to $118 billion with a 24-hour trading volume reaching $9.18 billion, a 39.35% increase.

Moreover, Bitwise has had a strong year as well, seeing its assets grow by 400%. With its successful Bitcoin ETF drawing over $2 billion in inflows, Bitwise is now looking to ride the wave of interest in Solana and expand its crypto offerings.

The firm also filled for spot XRP ETF in Delaware on October 1, after incorporating the Bitwise XRP ETF in late September.

Also Read: Bitcoin ETFs Reach $100B with Massive Inflows in 2024