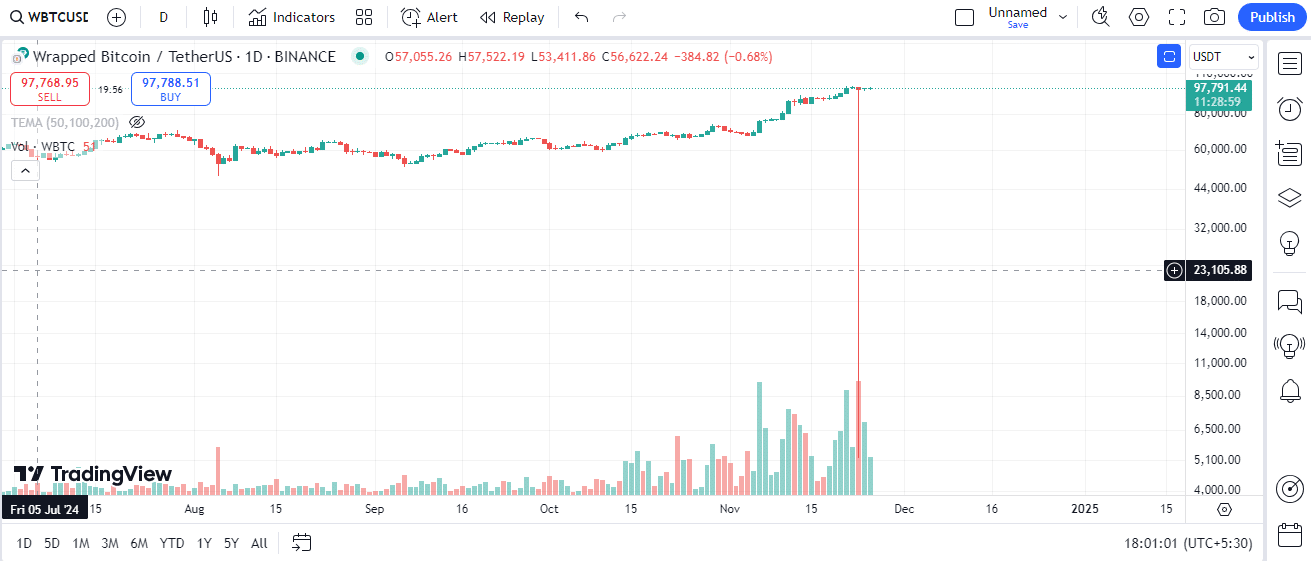

Wrapped Bitcoin (WBTC) experienced a shocking flash crash on Binance, plummeting nearly 95% from $98,500 to $5,209 in less than an hour on Nov. 23 before rebounding to around $98,000. The cause of the dramatic plunge remains unclear, with no comments from BitGo—the issuer of WBTC—or its team.

This event follows Coinbase’s announcement to delist WBTC, effective Dec. 19, citing liquidity concerns. Simultaneously, Coinbase is advancing its own competitor, Coinbase Wrapped Bitcoin (cbBTC), further shaking up the tokenized Bitcoin market.

The delisting has strained relations between Coinbase and Justin Sun, whose joint venture with BitGo is linked to WBTC. Sun has been vocal about the competitive landscape, accusing Coinbase of failing to provide proof-of-reserves for its cbBTC token.

The wrapped Bitcoin market is witnessing increased competition, with Kraken introducing its version, kBTC. Meanwhile, the flash crash raises questions about the stability of WBTC, a key player in decentralized finance (DeFi) with a market capitalization of approximately $14 billion.

Launched in 2019, WBTC enables Bitcoin liquidity to integrate with DeFi platforms, pegged 1:1 with Bitcoin. Despite its recovery, the incident underscores the potential volatility in tokenized assets and the growing rivalry among issuers.