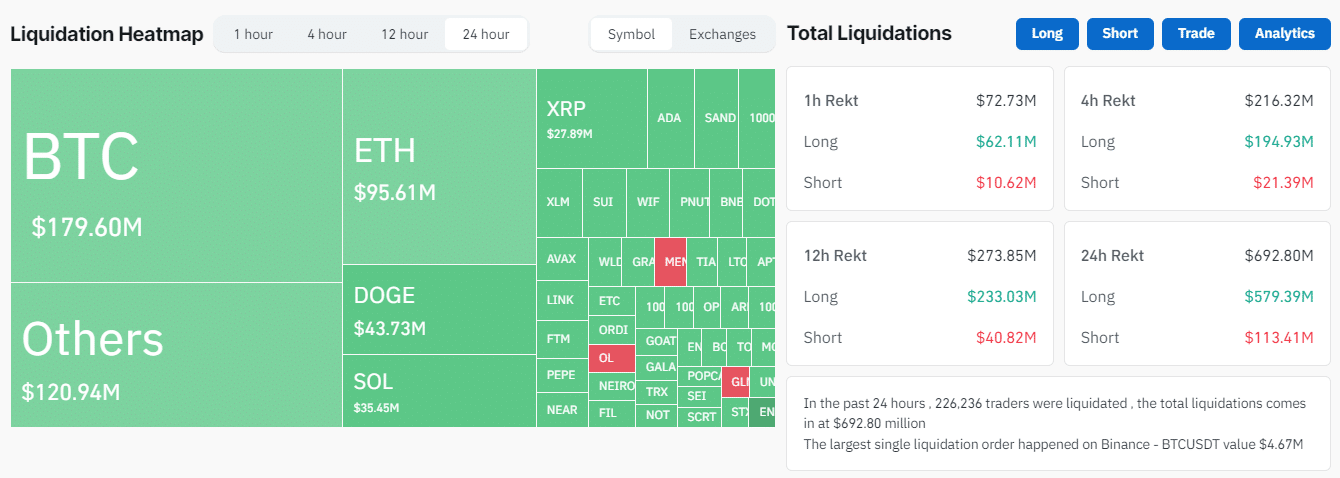

Bitcoin’s price has dipped below $92,000, erasing some of its recent gains from a rally that saw it approach $99,000 last week. The correction has triggered a wave of liquidations totaling $693 million in the past 24 hours, with $577 million in long positions and $133.87 million in shorts being wiped out.

Approximately 226,244 traders were liquidated, with the largest single liquidation order—valued at $4.67 million—occurring on Binance in the BTCUSDT pair.

Other major cryptocurrencies also faced sharp liquidations: Ethereum ($95.61M), Dogecoin ($43.73M), XRP ($27.89M), and Solana ($35.45M) all posted substantial losses.

Bitcoin is currently trading at $91,895, down 6% in the last 24 hours, bringing its market cap to $1.82 trillion. Despite the pullback, Bitcoin remains up 31% since the start of November, reflecting strong overall market momentum fueled by altcoin rallies and memecoins, which recently surged by as much as 20%.

Market analysts note that while the current dip may reflect a cooling-off period, Bitcoin’s trajectory in recent weeks showcases its resilience amid heightened speculative interest.

Also Read: Bitcoin (BTC) $100,000 Deja Vu: All it needs is a little push