MicroStrategy has experienced its largest four-day market capitalization decline in history, losing over 35% of its value since November 21, equating to more than $30 billion. This significant drop has reignited discussions about its role as a leveraged Bitcoin investment vehicle.

The Kobeissi Letter highlighted this unprecedented drop in a November 26 post on X, sparking questions about the company’s position as a leveraged Bitcoin investment vehicle.

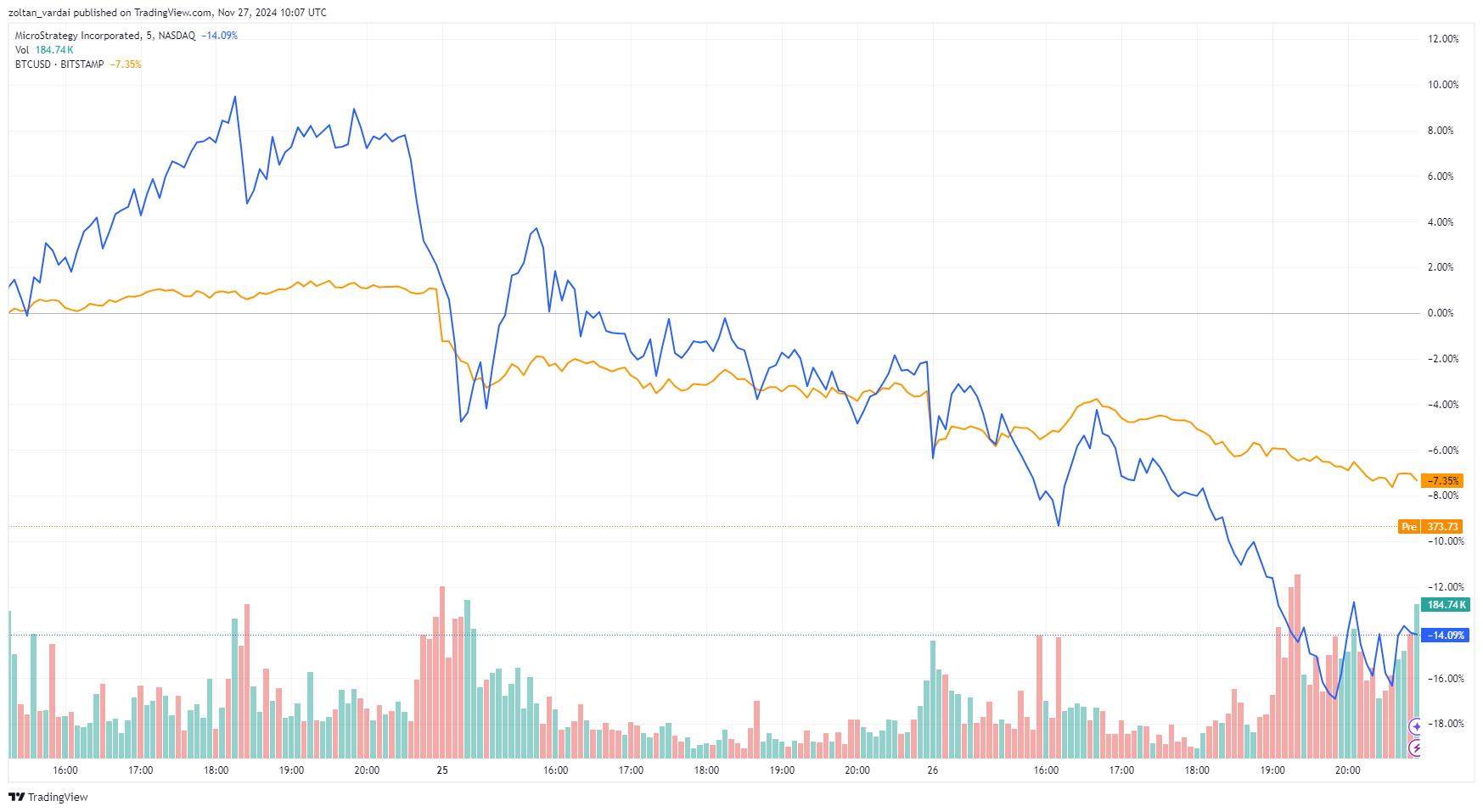

MicroStrategy’s market cap fell by $30 billion, with its stock price (MSTR) plunging 35% over four trading days—its biggest drop on record, as noted by the Kobeissi Letter. The stock decline mirrored Bitcoin’s correction after it hit an all-time high of $99,800 on November 22. MSTR fell an additional 7.5% on November 27, trading at $354.10.

The Kobeissi Letter revealed that retail investors have been increasingly active in trading MicroStrategy stock, purchasing nearly $100 million worth of MSTR in the past week. On November 22, retail buyers spent $42 million on MSTR stock—the highest daily purchase on record.

Major institutions like Allianz acquired over 24% of MicroStrategy’s $600 million note offering in March, demonstrating continued interest in the company’s Bitcoin-centric strategy.

Despite the recent correction, both Bitcoin and MicroStrategy have posted strong gains over a broader timeframe. In the past month, Bitcoin has risen 44%, while MicroStrategy’s stock rallied by over 32%.

On a yearly scale, Bitcoin’s price has surged 146%, whereas MicroStrategy’s stock has skyrocketed by more than 599%, underscoring its leveraged exposure to the cryptocurrency’s performance. MicroStrategy’s $2.6 billion note offering has also fueled investor interest, reinforcing the company’s commitment to its Bitcoin-centric strategy.

The Kobeissi Letter emphasized the growing volatility of MSTR, noting its 35% drop was over four times Bitcoin’s correction. The report attributed this to heightened retail interest, raising concerns about MicroStrategy’s role as a Bitcoin proxy.

As Bitcoin approaches $100K, MicroStrategy’s dual identity as a business intelligence firm and Bitcoin holding vehicle will remain under scrutiny.

Also Read: MicroStrategy Buys 55,500 BTC for $5.4B, largest in history