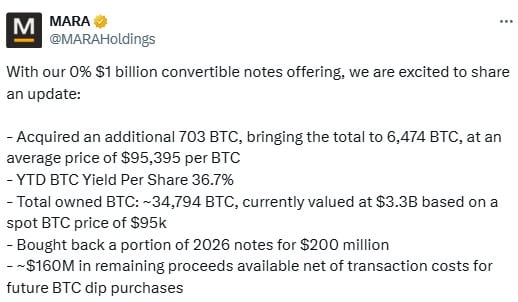

MARA, formerly Marathon Digital, has made a bold move in the Bitcoin space. On November 28, the company revealed it acquired 6,474 BTC through its recent $1 billion convertible note offering at a 0% interest rate.

This includes an additional 703 BTC purchased on 28 November after its initial buy of 5,771 BTC on November 23. Both these purchases now has an average price of $95,395 per coin. MARA now holds 34,797 BTC in its treasury, valued at $3.3 billion.

Following its strategy, MARA also repurchased a portion of its 2026 notes for $200 million. The company plans to use the remaining $160 million from the debt raise to buy more Bitcoin during price dips.

This approach mirrors MicroStrategy, which has used corporate debt to amass Bitcoin since 2020. Recently, MicroStrategy issued $3 billion in senior convertible notes at 0% interest to fund Bitcoin purchases. Between November 18 and 24, the company bought 55,000 BTC at an average price of $97,862 per coin, pushing its total holdings to 386,700 BTC.

However, only some people support this high-risk strategy. Critics warn that using debt to buy Bitcoin could lead to financial trouble if Bitcoin’s price drops sharply. While MicroStrategy’s shares fell 25% on November 21, its repayment obligations won’t hit until 2028, giving it time to weather market fluctuations.

With MARA and MicroStrategy doubling down on Bitcoin, these moves could signal a new wave of corporate interest in digital assets — or a gamble that’s yet to pay off.