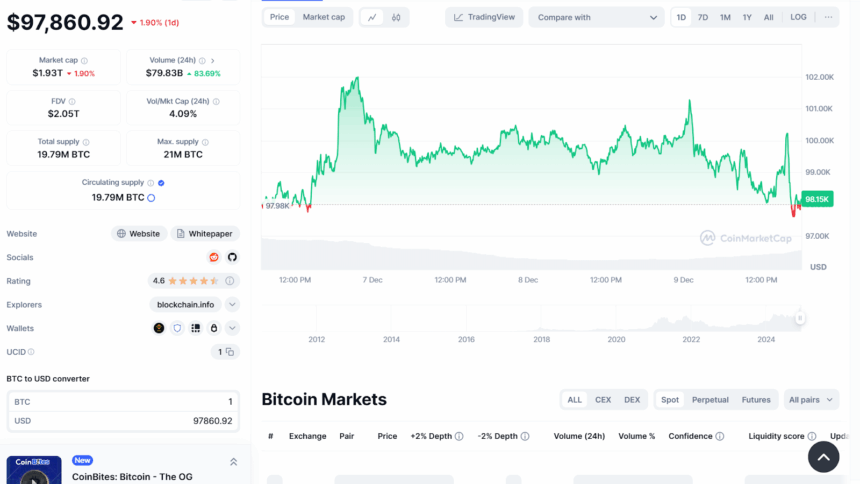

Bitcoin’s price dropped to $97,860 today after several weeks of continuous rallies. Just days ago, Bitcoin was soaring at a record high of $103.9K, thanks to the momentum from Donald Trump winning the election on November 6.

However, the price momentum quickly slowed down as Bitcoin struggled to maintain its gains in the past few days.

It’s just not bitcoin. Other major cryptocurrencies also experienced a price fall. For instance, Ethereum briefly hit $4K earlier today but then dropped by 3%. This was also the same time around which Justin Sun sold a huge chunk of Ethereum worth $119 million to HTX, which added pressure on the market.

But some altcoins are still performing well. PEPE hit a new record high, and X Empire saw a big 47% jump this week, giving some hope to investors.

The selling pressure has gone over the roof. The data from Coinglass shows that 204,384 traders were liquidated for a total of $509.48 million. On top of that, the Bhutan Government sold $40 million worth of Bitcoin to QCP Capital, which added to the downward pressure.

Additionally, the expiration of around 39,960 Bitcoin options contracts on December 27 left many investors worried about further price drops in the coming weeks. Plus, the Cardano Foundation’s social media account got hacked, which made people more nervous about investing in crypto.

Despite all this, some experts think the bull run isn’t over yet. Many believe the market will be bullish throughout next year.

Some even think this could be the start of an “altcoin season,” where smaller coins gain more attention as Bitcoin’s dominance fades. The Altcoin Season Index has dropped from 86 to 73 this month, showing that altcoins are holding strong grounds.

Also, the Federal Reserve’s meetings and economic report including the CPI, PPI, and Import and Export price index could possibly change the market trajectory. This recent pullback might have created some uncertainty, but it could also be a chance for investors to buy at lower prices.

Also Read: MicroStrategy Buys 21,550 Bitcoin for $2.1 billion