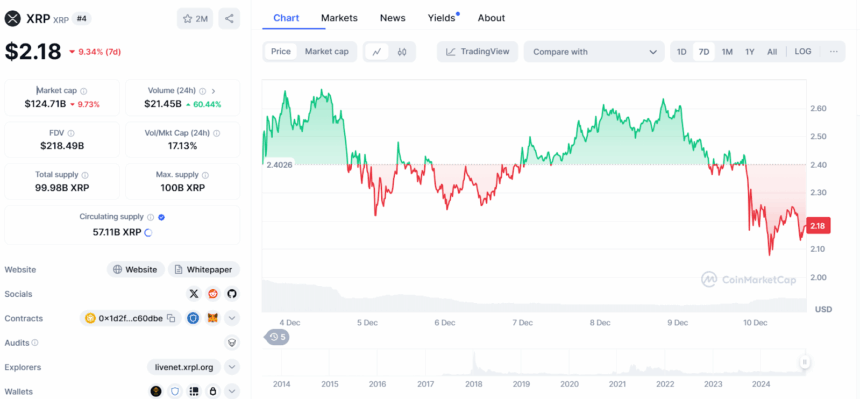

XRP recently surged above $2.50, recording over 400% gains from its $1 breakout. This pump was due Ripple’s progress in its legal issue with the SEC alongside the recent push for clear crypto rules in the space. But then, XRP hit a roadblock at $2.40 and started falling back.

During the downturn, over $53 million in long positions were liquidated in a single day, with short liquidations capped at $13 million. More recently, $12 million in longs and $4.2 million in shorts were liquidated, having a growing pressure on XRP’s price.

According to On-Chain Data, many smaller investors have exited their positions, while larger holders, or “whales,” may also be selling as the price struggles to maintain its support.

Now, all eyes are on the $2.00 mark. This price is a critical level that often acts as a strong support or a tipping point for further drops. If XRP dips below $2.00, analysts predict it could tumble further to $1.88 or even $1.75, as liquidations could pile up fast.

Technical indicators are also indicating the similar sentiment. The daily Relative Strength Index (RSI) has dropped from overbought levels to 60.65, and this only means that the bullish momentum is starting to fade. The On-Balance Volume (OBV) also shows less buying activity, and the MACD is signaling increased selling pressure.

If XRP can bounce back from $2.00, it might recover to $2.50 or higher, keeping the bullish vibe alive. However, failing to hold this support level could bring sharp swings and complicate the path to recovery.

For now, the crypto is down 9% to $2.18 today with also a 9% drop in Market Capitalization to $124 billion, according to the data from CoinMarketCap.

Also Read: Ripple Whales Buys 120M XRP During Recent Market Pullback