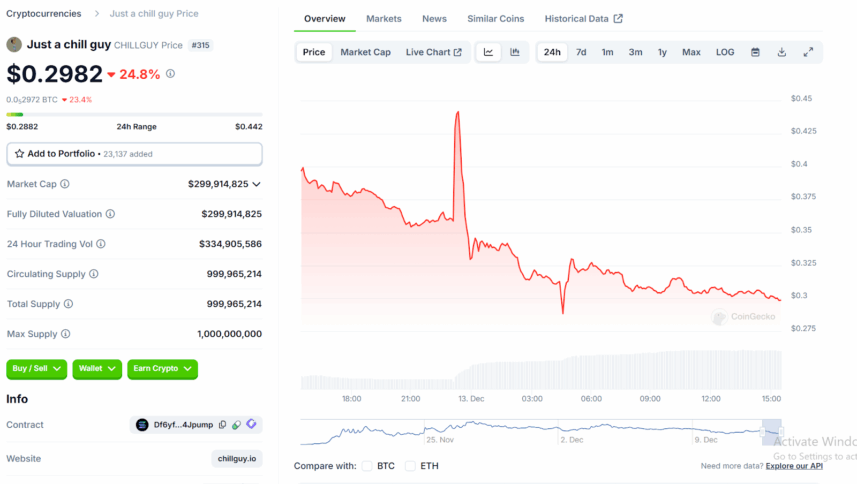

The ChillGuy meme coin fell by over 25% within 30 minutes after the project was denied to not hold any rights over the original Chill Guy meme.

The price fell from $0.4793 to $0.2677, with market capitalization down to $299 million, and trading volumes jumping up by 172%, which means investors holding on to their coins started selling.

Philip Banks, the creator of Chill Guy meme, said he never gave any IP or licensing rights to the ChillGuy crypto project. He also explained how hackers gained control of his social media accounts to impersonate him, falsely claiming he had given them IP permission.

The coin became popular because it had a vibe that many people could relate to, especially Gen Z and those who like memes. It was launched on November 15 on the Solana blockchain, quickly hitting a market capitalization of $561 million by November 27. The value went up even more after it was listed on Binance but started to drop when the IP controversy came up.

The hacked tweets from Banks’ X (formerly Twitter) account caused the token to go up by 30%, reaching $0.44 before this development made it drop. The crypto team and community of ChillGuy pointed out that the posts were suspicious and later confirmed the hacking. As of now, all fake tweets have been taken down.

Aside from the ChillGuy issue, there have been reports of market manipulation as on-chain data showed that the market maker Wintermute bought $1.2 million worth of CHILLGUY tokens before the hacked tweet went live and later sold them for big profits, bringing into question the validity of trading practices during the chaos.

Banks wants to ensure that he gets copyright protection in order to prevent others from using his artwork without permission, specifically in cryptocurrency.

“The meme is not officially linked to the token,” he reiterated in his statements. The current problems show the dangers of investing in meme coins, which usually have no real value and are influenced by excitement and market changes.

Also Read: VIRTUAL Surges 28% in 24 hours as AI Agent Trend Emerges