The Pi Network, a revolutionary mobile mining platform, is poised to disrupt the cryptocurrency landscape. But to unlock the full potential of your Pi, securing your account through KYC (Know Your Customer) verification is essential to ensure the authenticity of users on the Pi Network.

With the KYC deadline approaching on December 31st, it’s crucial for users to complete this process promptly.

To successfully complete this process, applicants need to fulfill specific requirements and follow a structured application process. Here’s a detailed guide to help you through.

Eligibility Criteria to Apply for Pi Network KYC

Before starting the KYC application, ensure you meet the following requirements:

- Age Requirement: You must be 18 years or older.

- Government-Issued ID: You need to have the original copy of any one document, Passport (recommended), Driving License, National ID

- Clear Face for Liveness Check: Ensure your face is easily recognizable and matches the ID before starting the verification.

- Mining Duration: You must have mined Pi for at least 30 days.

- Time Commitment: The KYC application process takes approximately 5-10 minutes

Note: Eligibility, requirements, and availability may vary by country.

Steps to Complete the KYC Verification Process

Step 1: Install the Pi Browser App

- Download the Pi Browser app from the Google Play Store or Apple App Store.

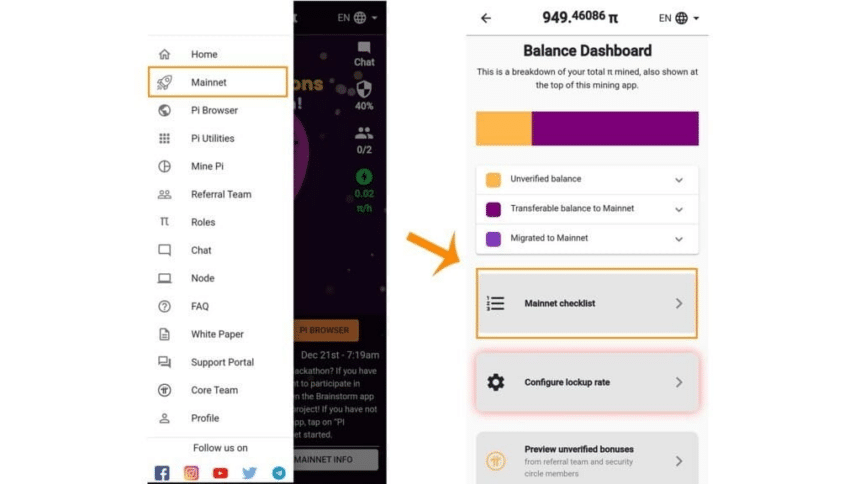

Step 2: Access the Mainnet Section

Open the Pi Network app and navigate to the Mainnet section via the side menu.

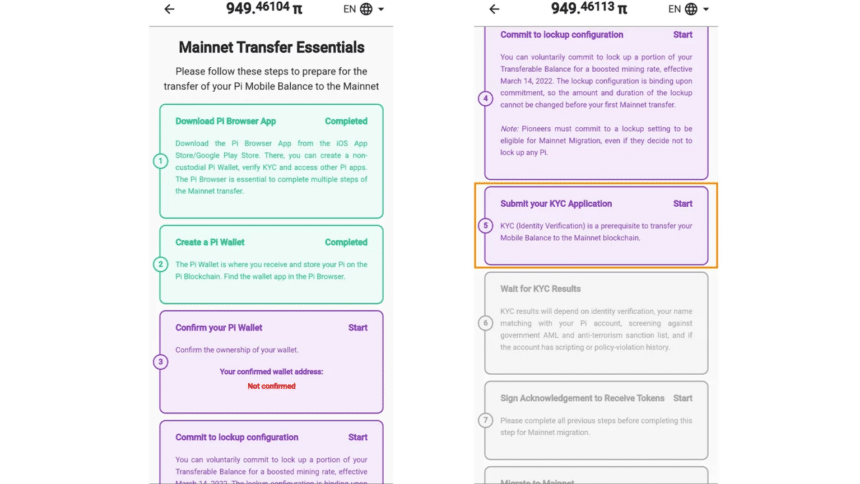

Step 3: Complete Mainnet Checklist Tasks

- Go to the Mainnet checklist tab and complete all tasks up to the “Submit your KYC Application” task.

Step 4: Start the KYC Application

- After finishing the prerequisite tasks, the KYC application tab will unlock. If not, manually access the “kyc.pi” area in the Pi Browser app.

Step 5: Select Your Country

- On the KYC section’s first screen, select your country from a drop-down menu.

Step 6: Choose Your ID Document

- Choose the type of ID document you will use for verification, with a passport being recommended.

Step 7: Follow ID Instructions

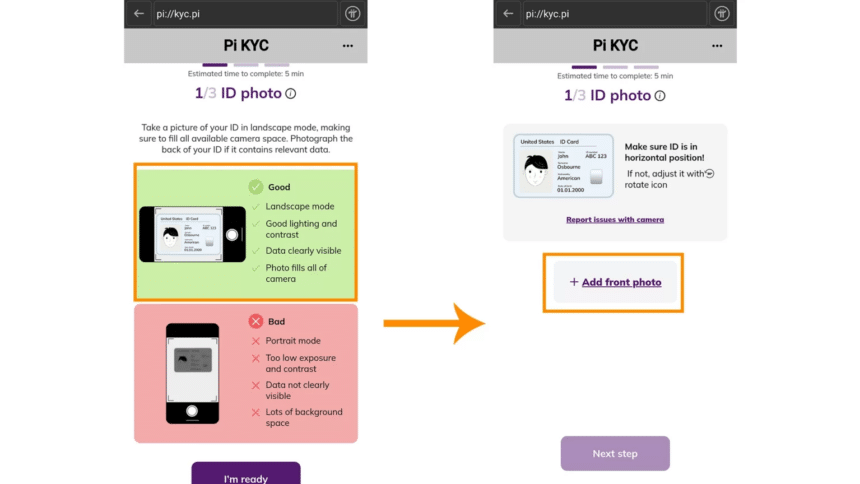

- Read the instructions on the four slides carefully, then proceed.

Step 8: Capture ID Photos

- Tap “Add front photo,” and take a clear image of your ID’s front. If required, add a back photo as well.

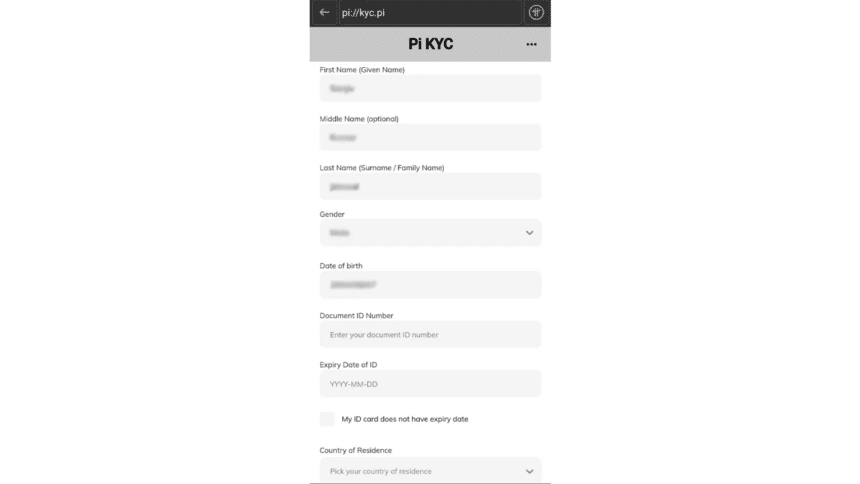

Step 9: Fill Out the Form

Fill out the form with information matching your ID document, including:

- First name

- Middle name (optional)

- Last name

- Gender

- Date of Birth

- Document ID number

- Expiry date of ID

- Country of Residence

Step 10: Complete the Liveness Check

- Click on the “I’m Ready” button for a liveness check, ensuring your face is clearly visible to the camera.

Post-Application Process

Approval Timeframe

- KYC approval can take from a few minutes to several months, depending on the accuracy of your information and the availability of validators in your country.

Checking Your KYC Status

- Check your KYC status in your Pi Network app profile. A green checkmark indicates verification, while a loading animation means your application is still pending.

- Alternatively, check the Mainnet checklist section. If the “Wait for KYC results” tab is green, your KYC is verified.

Application Review Process

- Your KYC application will be reviewed by previously verified Pi users. Each application is validated by at least two KYC-verified individuals from your country.

Application Fee

- The KYC process costs 1 PI coin, which is rewarded to the validators.

For further information, visit the Pi Network’s official KYC FAQs.

Conclusion

Securing your Pi Network account through KYC verification is crucial for unlocking the full potential of your Pi. This process ensures user authenticity and involves specific requirements, such as being 18 years or older, having a government-issued ID, and a clear face for the liveness check. Following a structured application process, from installing the Pi Browser app to completing the liveness check, is essential. KYC approval varies in time, and successful verification is indicated in your Pi Network app profile. For more details, refer to the Pi Network’s official KYC FAQs.

Also Read: Pi Network Calls Users to Step Up as KYC Validators