World Liberty Financial, the crypto project backed by Donald Trump and his family, has been on a major buying spree in December. The project has spent nearly $45 million on various cryptocurrencies, including Ether (ETH), Coinbase Wrapped Bitcoin (cbBTC), Chainlink (LINK), and others.

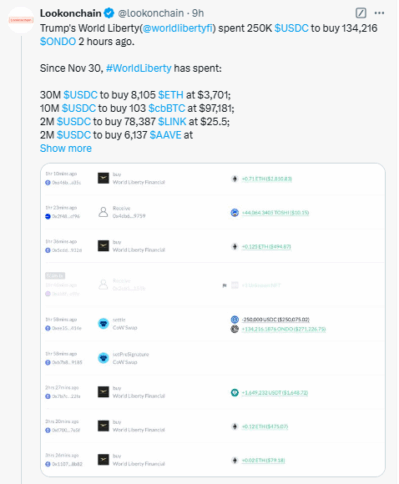

The latest purchase, made on December 15, saw World Liberty buy $250,000 worth of Ondo (ONDO), a token connected to decentralized finance (DeFi). This followed a $500,000 purchase of Ethena (ENA) just one day earlier.

Breakdown of the project’s buying activity

- $30 million in Ether (ETH)

- $10 million in Coinbase Wrapped Bitcoin (cbBTC)

- $2 million in Chainlink (LINK)

- $2 million in Aave (AAVE)

- $500,000 in Ethena (ENA)

- $250,000 in Ondo (ONDO)

This brings their total spending for December to $44.75 million.

What is World Liberty Financial?

World Liberty’s token sales haven’t exactly gone as planned. The project struggled to sell its $300 million World Liberty Financial (WLFI) token, selling less than 25% so far. However, things took a turn when Justin Sun, the founder of the Tron blockchain, bought $30 million worth of WLFI tokens, becoming the project’s largest investor and advisor.

AaveDAO Collaboration

In addition to its token buys, World Liberty made headlines in the DeFi community on December 13, when the autonomous group behind the Aave protocol, AaveDAO, approved a proposal from World Liberty.

The proposal allows World Liberty to launch its version of the Aave protocol for lending and borrowing digital assets like Ether, Wrapped Bitcoin, and stablecoins like USDC and USDT.

Why the Buying Spree?

According to Nicolai Søndergaard, a researcher at Nansen, World Liberty’s buying spree could be a strategy to gain credibility in the crypto world. By investing heavily in well-known assets like Ether and Aave, the project may be looking to boost confidence and attract more investors as the market reacts to the rise in value of these assets.

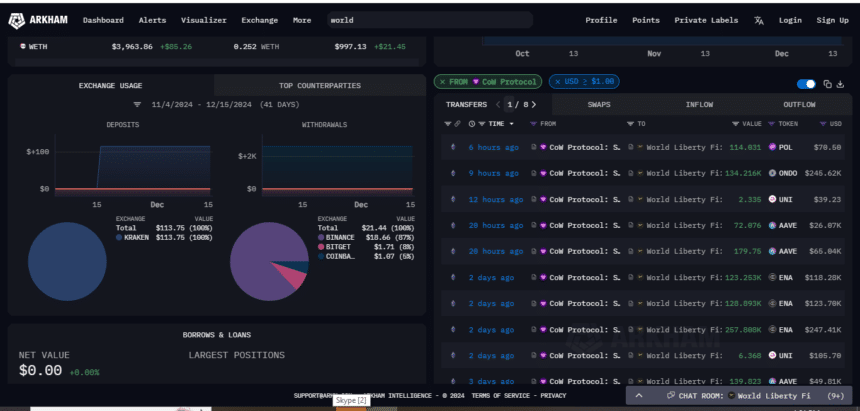

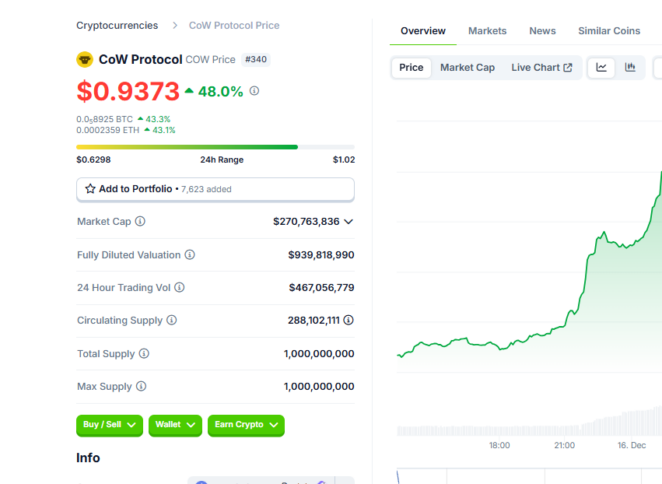

Cow Protocol’s Surging Popularity

In addition to the buying spree, World Liberty’s purchases through the Cow Protocol have also influenced the market.

Cow Protocol’s tokens have surged almost 50% in price, currently valued at $0.9373, following the Trump family’s purchases, jumping to $270 million market capitalization and 24-hour trading volume standing at $467.48 million, surging a staggering 745%.

Also Read: Donald Trump Plans to “Do Something Great with Crypto”