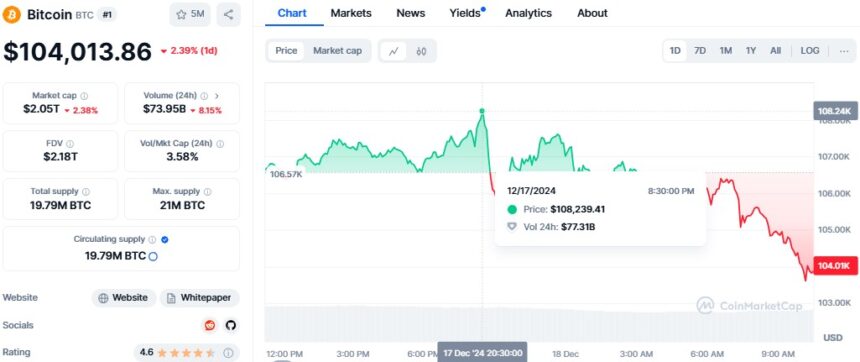

Bitcoin price took a brief pause after hitting an all-time high of $108,239 on Tuesday, before retreating to $104,013. Despite this pullback, the overall value of crypto market reaching nearly $4 trillion during the rally, signaling strong investor interest.

Traders are optimistic, especially with President-elect Donald Trump’s support for crypto. Trump’s promise to create favorable regulations and even establish a national Bitcoin reserve has fueled market enthusiasm.

Additionally, MicroStrategy’s inclusion in the Nasdaq 100 Index is boosting market sentiment, with expectations that this could lead to further price gains, given the company’s focus on Bitcoin investments.

The Federal Reserve is widely expected to cut interest rates by another quarter-point, but the outlook for next year remains uncertain due to robust US economic growth and potential inflation risks from Trump’s policies.

K33 Research analysts expect the Fed’s final monetary policy meeting of 2024 to contribute to market volatility, though they anticipate Bitcoin momentum may continue building through the holiday season.

Bitcoin has surged over 55% since Trump’s victory in the presidential election, with investors turning to Bitcoin exchange-traded funds despite the token’s volatility and lack of traditional valuation.

The Deribit options exchange shows significant interest in Bitcoin reaching $120,000, though analysts, like IG Australia’s Tony Sycamore, caution that chasing Bitcoin at its current levels could be risky.

Also Read: Ohio Introduces Bitcoin Reserve Bill to Buy BTC For Reserve