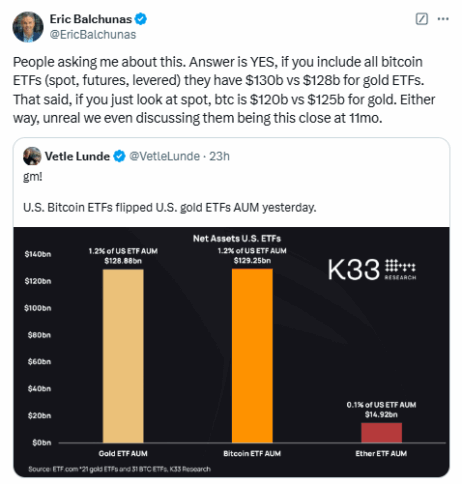

Bitcoin exchange-traded funds (ETFs) have now, for the first time, surpassed gold ETFs in assets under management (AUM). According to K33 Research and Bloomberg analyst Eric Balchunas, the U.S. Bitcoin ETFs hit a combined total of $129 billion, overtaking the $128 billion held by gold ETFs on December 16, 2024.

This is an extremely strong time for Bitcoin because these ETFs were just launched 11 months ago, whereas gold ETFs have been present in the market for more than 20 years. This boom in the growth of Bitcoin ETFs reflects the increased institutional investors demanding cryptocurrencies and also optimism toward Bitcoin’s future.

The leader of the pack is BlackRock’s iShares Bitcoin Trust (IBIT), which now holds nearly $60 billion in assets, even surpassing BlackRock’s gold ETF, iShares Gold Trust (IAU), earlier this year.

Now that Bitcoin ETFs have surpassed gold in overall AUM, gold has an edge by a tiny margin when looking at spot ETFs specifically. Gold’s spot ETFs are valued at around $125 billion and Bitcoin’s spot ETFs at about $120 billion. That’s a pretty small gap in how far Bitcoin has traveled in such a short space of time.

The bitcoin ETFs are riding the wave of the “debasement trade,” an investment trend. The strategy is that with increasing global economic uncertainty, high inflation, and concern over increasing government deficits, investors look for safe-haven assets such as Bitcoin and gold.

In response to this, Bitcoin’s price has increased and pushed the ratio of Bitcoin-to-gold to its all-time highest.

Over 2024 alone, the spot Bitcoin ETFs have already taken in over 500,000 Bitcoin or even 2.5% of all Bitcoin in circulation. In today’s world, it’s the largest Bitcoin holder of all time and already has surpassed the iconic Satoshi Nakamoto wallet. There is no doubt that US-based Bitcoin ETFs hold a monopoly at around 1.1 million BTC.

Analysts such as Bloomberg industry expert James Seyffart mention another point: it will not come until the deluge of brand-new cryptocurrency exchange-traded funds pour in in 2025 and potentially may not only come with the blended Bitcoin and Ether ETFs but could go beyond and include an opportunity for Litecoin ETFs and possibly even more digital coins.

Also Read: Bitfinex Analysts Forecast Bitcoin Could Hit $200K by 2025