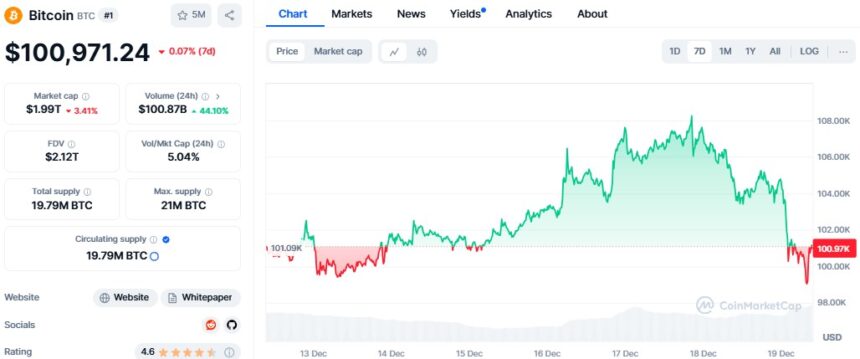

Bitcoin dipped below $100,000 on Wednesday night, dropping 6% in 24 hours to trade at $99,0477, following comments from U.S. Federal Reserve Chair Jerome Powell.

Powell rejected the idea of the U.S. forming a national Bitcoin reserve, stating that the central bank is “not looking for a law change” and is not allowed to hold Bitcoin. This led to a sharp correction after Bitcoin had briefly surged to a new all-time high of $108,000 earlier this week.

The impact was felt across the market, with major altcoins also seeing significant losses. Ethereum (ETH) dropped 6.5%, and XRP fell by 12.64%. The GMCI 30 index, which tracks the performance of top cryptocurrencies, declined by 7.18% in the past day.

Bitcoin’s recent rally had been fueled by U.S. President-elect Donald Trump’s comments about creating a national Bitcoin reserve. Several states, including Texas and Florida, had also seen efforts to build state-backed Bitcoin reserves, boosting market optimism.

Despite the pullback in the crypto market, Powell’s comments were just one piece of a larger economic picture. The U.S. Federal Reserve’s decision to cut interest rates by 25 basis points on Wednesday, while signaling fewer cuts in 2024, contributed to the market’s decline.

With ongoing uncertainty, many are watching closely to see how the market reacts to political shifts and economic changes in the coming months.

Also Read: Ohio Introduces Bitcoin Reserve Bill to Buy BTC For Reserve