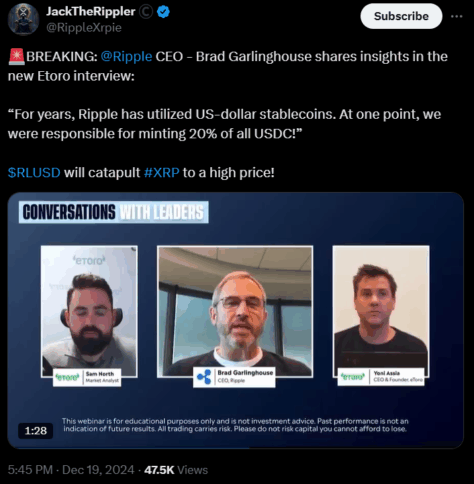

Ripple CEO, Brad Garlinghouse recently had an interview with eToro and he shared some significant updates about Ripple’s use of stablecoins.

He said that Ripple has been working with US-dollar stablecoins, especially USDC, for a long time. “At one point, we made 20% of all USDC!” Garlinghouse said.

Garlinghouse explained Ripple has worked with stablecoins in some of the key financial areas to help lower costs and speed up transactions for customers.

He also discussed RLUSD, the new stablecoin launched by Ripple and fully backed by deposits in U.S. dollars. The stablecoin, pegged at a ratio of 1:1 with the U.S. dollar, will hold one dollar in value for one RLUSD. Through RLUSD, Ripple said it aims to provide the market with a stable and efficient solution for digital transactions, predominantly for businesses that require fast and cheap payments.

The New York Department of Financial Services approved RLUSD on December 10, 2024. A week after, on December 17, RLUSD was officially launched on several exchanges such as Uphold, MoonPay, Archax, Bitso, and CoinMENA. Ripple plans to integrate RLUSD into its Payment Network in 2025 to enable businesses to assist their cross-border transactions.

Meanwhile, the launch of RLUSD stirred the market leading to an increase in Ripple’s native token, XRP. Right now, the token is down 8% to $2.26 after hitting a week’s high of $2.70. However, XRP has seen over 100% surge this month alone due to the RLUSD launch.

Despite this rise, Garlinghouse confirmed that RLUSD is not meant to replace XRP but rather complement it. XRP will remain the core digital currency for cross-border transactions, while RLUSD will allow companies a stablecoin option for cheap and seamless payments.

Also Read: Pro-XRP Lawyer Responds to SEC’s ‘Unregistered’ Claim on “RLUSD”