At the time of writing, Bitcoin is down over 6% in trade, just above the $95,000 level. This swift decline comes right after the Federal Reserve announcement of a 0.25% decrease in interest rates.

It brought about a negative reaction in the crypto market. The speech by Federal Reserve Chair Jerome Powell that the Fed can neither buy nor hold Bitcoin, sending investors into an even bigger panic.

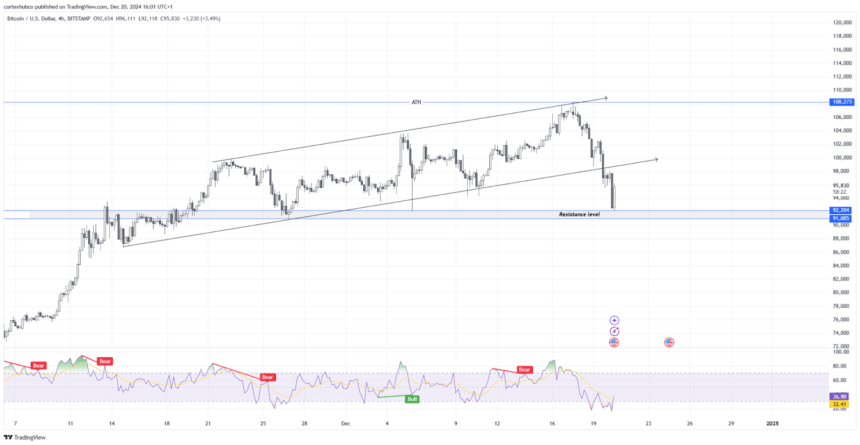

Now, analysts have located important support levels for Bitcoin between $91,000 and $92,000. In case of further declines, prices may further slip to $82,500. The fall occurred amidst high activity trading with more than $1 billion worth of leveraged positions being liquidated. The drop in Bitcoin’s price comes after the recent all-time high of $108,000.

The market performed well weeks ago, after being fueled by the purchase of 15,757 BTC by Mara Holdings and increased interest in Bitcoin mining equipment.

Additionally, U.S. President Donald Trump’s election win and his support for cryptocurrency had lifted investors’ spirits. But with those good signs, the market wasn’t ready for such a fast drop due to the Fed’s interest policy.

It comes in stark resemblance to a 2020 prediction by Binance CEO Changpeng Zhao, who took to X on Dec. 17 and said: “Waiting for the new headline: #Bitcoin ‘CRASHES’ from $101,000 to $85,000. Save the tweet.”

The confirmation of CZ’s prediction came with this drop, which caused new talks on X about the highly unpredictable nature of the markets for cryptocurrencies.

Meanwhile, this drop has a dual effect within the crypto community as some consider this a natural correction, while others consider it as a start of a long bearish phase. “The $100,000 level has proved difficult to break for Bitcoin,” said an analyst.

Also Read: Metaplanet Raises $61M to Accelerate Bitcoin Purchase