Bitcoin has been below $90,000 for the past 7 days, and Crypto trader Peter Brandt is warning that it could fall even further, possibly below $70,000.

He says it wouldn’t be surprising if Bitcoin takes a hit, especially since the market is already struggling with weak demand from big investors and global uncertainty ahead of Donald Trump’s Liberation Day next week.

Brandt, who is well-known for his market predictions, responded to a post on X (formerly Twitter) about Bitcoin’s current weakness. He pointed out that the price has been stuck under $90,000 for weeks, struggling to break through.

He believes that a bigger drop could be coming, saying, “It would not be unreasonable” for Bitcoin to fall below $70,000. If that happens, it would be an 18% crash from where it is now.

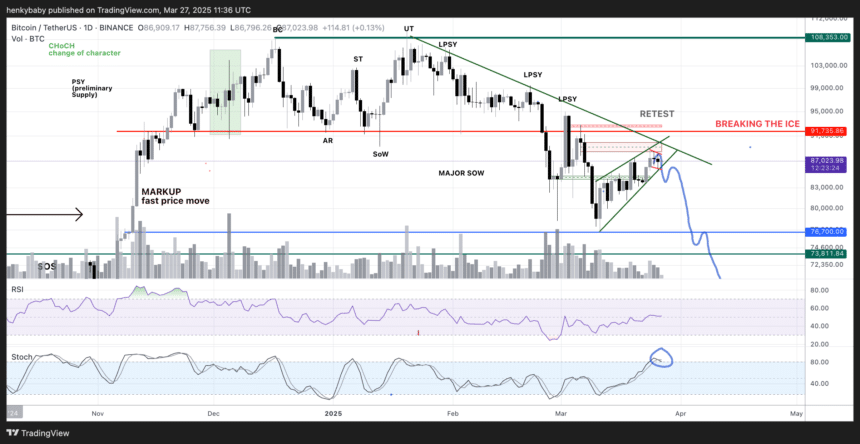

Bitcoin has been showing signs of a continuous downtrend throughout the month. The daily chart is forming a rising wedge pattern, which is often a warning signal that prices could drop. There’s also a double-top formation at $108,675, another classic sign of weakness.

If Bitcoin does fall, the price could stop for a while at $76,430, then possibly down to $73,827, and eventually under $70,000. On the flip side, if Bitcoin manages to break past $90,000, $95,000, and eventually $100,000, then the bearish outlook could change.

Moreover, one of the possible events that can fuel this bearish outlook is the massive options expiry happening on Friday, with over $16.5 billion worth of contracts set to expire. The maximum pain point, which is the price where most traders would lose money, is at $85,000. This means Bitcoin could be in for a wild ride as traders adjust their positions.

Another concern is the lack of interest from whales. Right now, data shows that fewer Bitcoins are moving to derivative markets, which could mean that large investors are holding back. In the past, this has been a bad sign for Bitcoin’s price.

On top of all this, Bitcoin faces a new challenge next week: Donald Trump’s Liberation Day. Trump is expected to introduce massive tariffs, which could shake up global markets. If investors start panicking, Bitcoin could feel the heat too.

Some analysts believe that if these tariffs lead to an economic slowdown, governments might respond with stimulus money and lower interest rates, which could be good for Bitcoin in the long run.

Also Read: XRP Price May face 40% Drop as Trump Tariffs Sparks Fear