Arthur Hayes, the co-founder of BitMEX, recently predicted that Bitcoin’s dominance in the cryptocurrency market will continue to rise, possibly reaching 70%.

In a tweet, Hayes said he has been increasing his Bitcoin holdings and avoiding altcoins. He wrote, “Been nibbling on $BTC all day, and shall continue. Shitcoins are getting in our strike zone but I think #bitcoin dominance keeps zooming towards 70%.”

This means Hayes believes Bitcoin will keep gaining more control of the market, even though altcoins are losing value.

According to Hayes, this rise in Bitcoin’s dominance is linked to U.S. monetary policies. He pointed out that the Federal Reserve could cut interest rates, which would lead to the central bank printing more money printing.

Hayes believes that when more money is printed, Bitcoin will become a better choice for investors as it’s seen as a safe place to store value. In other words, Hayes believes Bitcoin will perform well because it is seen as a hedge against inflation.

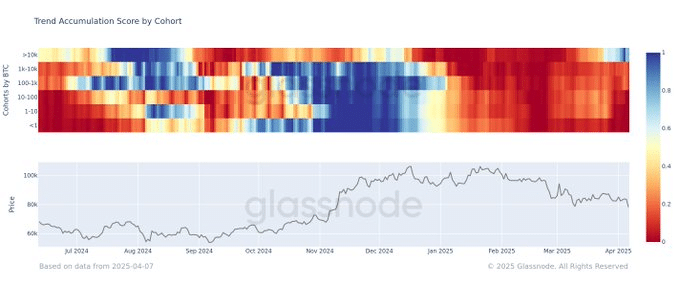

Moreover, Hayes’ prediction is backed by data from Glassnode, an on-chain analytics company. Glassnode noticed that Bitcoin whales, or large holders of Bitcoin, are buying even more Bitcoin.

At the start of the month, Glassnode’s data showed a high level of Bitcoin accumulation among whales, with an “accumulation score” close to 1.0. This score shows that whales have been buying a lot of Bitcoin in a short period of time.

However, the score dropped to 0.65, but it still indicates that whales are continuing to buy. On the other hand, smaller Bitcoin holders are selling off their coins, creating a difference between the actions of large and small investors.

Furthermore, Bitcoin’s Price seems to be tapping off a support lever at around. $74,000. Glassnode says this price point aligns with a supply zone where over 50,000 Bitcoin are concentrated. This could mean that Bitcoin’s price has found a stable level, which could help it recover if the market improves.

However, technical analyst Ted from OKX noted that Bitcoin’s ability to reclaim the 50-EMA level will be crucial in determining the next move. If it doesn’t, Bitcoin could drop to around $67,000 or $70,000.

BTC is trying to reclaim the weekly 50-EMA level. This has acted as a bull/bear line for BTC,” Ted said on X.

Also Read: Crypto Cynic Peter Schiff now predicts Ethereum below $1000