Ethereum (ETH) is once again in the spotlight as it plunged below $1,600 in a latest market move after pumping over 12% a day before. While this downtrend looks like just another dip, it has triggered alarms across the crypto market with analysts expecting ETH to continue with bearish sentiment amid the uncertainty in global markets.

As the broader crypto market is facing huge sell-off in a highly volatile market phase, Ethereum is losing its ground in the DeFi space with disappointing investors for a dozen times now. Some analysts even now believes that ETH price may face a more deeper correction before any sustainable recovery.

As per latest market data, ETH price is currently trading at $1,516 and it is down 7.55% in the past 24 hours while it surged 12% for the same period yesterday. This suggest huge volatility in ETH markets while showcasing thin liquidity and loosen investor confidence in it.

The below chart shows how ETH price has been performing in the past two weeks with it quickly gaining to $1,677 yesterday and now again falling near $1,500 in a latest move.

While it keeps underperforming, investors are now curious and want to know what it is that holds back ETH to attain likable gains! Let’s explore the three key reasons why ETH price outlook has turned bearish.

3 Reasons Behind ETH’s Bearish Trajectory

1. Market Uncertainty Returns Amid Trump’s Tariff Rhetoric

The global trade and finance markets have been thrown into a state of major uncertainty after the U.S. President Donald Trump’s tariff announcements. Trump’s recent tariff remarks on China and other trade partners have caused a ripple effect across equities and crypto.

While the crypto market is often seen as a hedge or high-risk asset class, it has now become increasingly volatile under such geopolitical pressures with leading crypto assets like ETH and BTC absorbing most impact.

Amid such market conditions, investors are growing cautious and it has translated into a broad sell-off, with Ethereum not spared. Historically, ETH has struggled to gain traction in times of global financial unease and the current market climate is no exception.

2. Ethereum’s Dim DeFi Activity

Ethereum has long been the backbone of decentralized finance (DeFi) but its dominance is now being challenged. The emergence of various layer 1 competitors like Solana are rapidly gaining traction with offering lower transaction fees, faster throughput than Ethereum. Besides, major DeFi protocols are expanding their reach to other efficient blockchain ecosystems with pulling liquidity away from Ethereum.

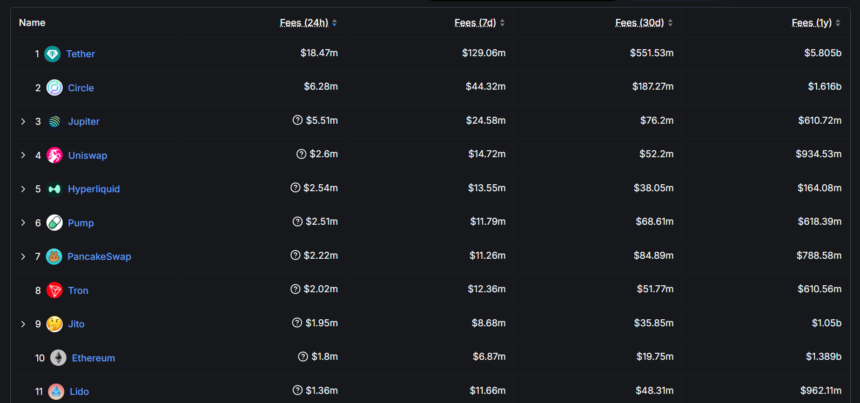

As per DeFillama data, Ethereum is losing its long-dominating aspects in DeFi from accumulating most fees and revenues to having largest DEX volumes.

This waning activity in the Ethereum DeFi ecosystem is reducing overall network utility and weakening bullish sentiment.

3. ETH’s Underperformance Raises Long-Term Concerns

ETH’s price trajectory over the past two years has raised serious concerns about its long-term competitiveness. After peaking near $4,800 in November 2021, ETH has struggled to maintain momentum.

Despite the much-anticipated upgrades like Dencun, Ethereum has failed to significantly outperform other major assets or show resilience during recovery phases.

More worryingly, Ethereum’s current price has dropped below its realized price – an onchain metric that measures the average price of all ETH last moved on-chain. Historically, this has been a bearish signal.

Similar breakdowns in June and November 2022 preceded price drops of 51% and 35%, respectively. The reappearance of this pattern suggests ETH could be headed for another steep correction.

Also Read: Tokenized Gold Trading Hits $1B for First Time Since 2023