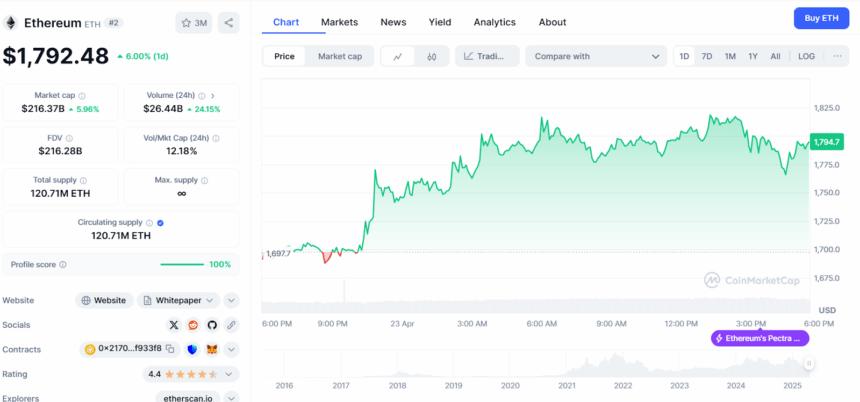

Ethereum’s price went up by nearly 6% in the last 24 hours, with a lot of trading jumping in to the market again. Trading Volume has gone up by 18% over the same period of time, according to CoinMarketCap

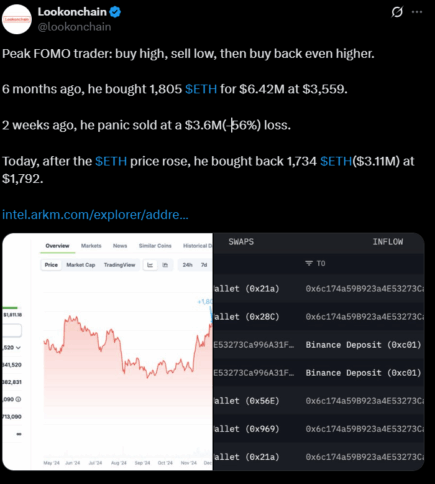

According to on-chain tracking platform Lookonchain, one particular trader showed what it called “peak FOMO behavior,” buying and selling ETH in a rollercoaster pattern.

This trader first bought 1,805 Ethereum (ETH) coins about six months ago. Back then, ETH was priced at $3,559, and the total cost was about $6.42 million. But the price dropped after that, and they held onto the coins for months. Then, just two weeks ago, the trader decided to sell everything.

Unfortunately for them, they sold at a big loss. The ETH was worth much less at that point, and they lost about $3.6 million. Soon after they sold, the price started going up again.

Now, that same trader is back. They’ve just bought 1,734 ETH for about $3.11 million. That comes to around $1,792 per coin. So, not only did they sell low, but they also bought again at a higher price than what they sold for. Lookonchain described this kind of trading as “buy high, sell low, then buy back even higher,” which is usually not a good plan.

At the same time, a whale has also pulled out 5,531 ETH, worth around $9.8 million, from Binance in just an hour. Another wallet, called 0x2088, spent 4.61 million USDC to buy 2,568 ETH at about $1,794 per coin. All of this happened very quickly.

Lookonchain also found a wallet that borrowed 15,000 ETH (about $24.9 million) from the crypto platform Aave. That same wallet later took out even more, about 35,754 ETH, worth $64.13 million, and sold it all within three hours, also around the $1,794 price.

Right now, ETH is trading for $1,792, a 13% surge in the last 7 days with a 5.96% increase in its market cap.

Also Read: Pi Token Crashes, But Founders May Be Crypto Billionaires