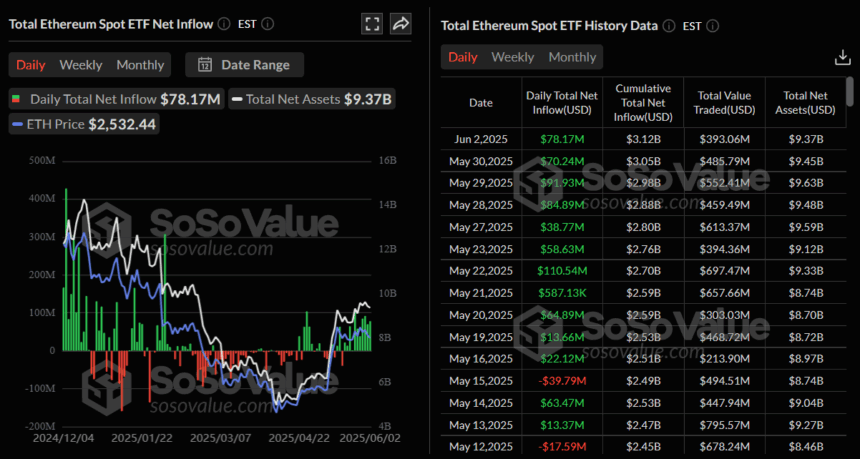

The spot Ethereum ETFs in the U.S. have amassed over $634 million in net inflow over the straight 11-day streak. This notable traction in Ethereum ETFs coincides with the bullish sentiment around ETH, which has surged over 43% in the past 30 days.

As per Sosovalue data, the U.S. spot Ethereum ETFs have recorded continuous net inflow since 16 May, with it accumulating $78.17 million in the latest trading session on 2nd June. With these inflows, the total net assets in the Ethereum ETF have now reached $9.37 billion.

The surge in Ethereum ETFs comes amid diminishing inflows in the spot Bitcoin ETFs. Over the past three trading sessions, Bitcoin ETFs have lost $1.242 billion as they continue losing ground against emerging cryptocurrencies like Ethereum and Solana.

Since the beginning of May, Ethereum has caught significant attention from market players as it shifted from an oversold to the most buoyed asset. Several large institutions have started focusing on Ethereum, with SharpLink, a well-known gaming-marketing firm, making a bold move by announcing a plan to purchase $1 billion of Ethereum. All these pushes have fueled Ethereum, with its price continuing with the bullish run.

At the time of writing, Ethereum (ETH) is trading at $2,618—up 5.50% in the past 24 hours. Its daily trading volume has also continually gained since May, which currently sits at $21.17 billion, a spike of 52% in the past 24 hours.

Also read: Ethereum Price Eyes $3000, Meme Coins PEPE & WIF Drive Market Rebound